INCONCRETO NEWS

Investment Boom in Anti-Obesity Medications

Overview of the Pharmaceutical Investment Surge

The anti-obesity drug market is projected to reach a value of $100 billion by 2030, as estimated by analysts from Goldman Sachs. While major pharmaceutical companies, including Pfizer, Amgen, Roche, and AstraZeneca, have outlined their strategies to enter this lucrative market, the forefront of the global fight against obesity is being led by two key players: Novo Nordisk and Eli Lilly.

In response to the escalating global obesity crisis, especially in Western nations, Novo Nordisk and Eli Lilly have made substantial investments, positioning themselves as frontrunners in this critical market. Novo Nordisk’s groundbreaking commitment of 2.1 billion euros to expand its facility in Chartres, France, and Eli Lilly’s significant investment in Fegersheim, Bas-Rhin, France, underscore their dedication to addressing the urgent public health issue of obesity. These multimillion and multibillion-euro initiatives from Novo Nordisk and Eli Lilly highlight their pivotal roles in spearheading efforts to combat the growing epidemic of obesity.

These companies have developed drugs targeting the GLP-1 hormone system to suppress appetite and aid weight loss. Obesity is linked to various health risks, such as cardiovascular diseases, diabetes, and cancers, contributing to enormous direct medical costs and economic burdens. Despite the potential benefits of anti-obesity drugs, concerns arise about the sustainability of their market dominance. The high cost of these drugs, around $1,000 per month, coupled with the emergence of newer appetite-suppressing drugs in development, poses challenges. The effectiveness of GLP-1 drugs, derived from data on Type 2 diabetes patients, may not translate seamlessly to the broader overweight population.

Losing weight, especially for those with a Body Mass Index (BMI) over 40, remains a complex challenge, and the notion that obesity drugs could replace other medical interventions like bariatric surgery or cardiac care seems unlikely. Health conditions associated with obesity, even after weight loss, may not fully revert to normal levels, ensuring a continuous demand for healthcare services and, consequently, huge profits for pharmaceutical companies.

The cumulative and irreversible nature of some health damages caused by obesity suggests a sustained market for healthcare companies.

As pointed by the FT.Adviser, Novo Nordisk’s results last year showed demand for its flagship anti-obesity drugs was very robust. Danish Novo Nordisk’s stock market value is now bigger than Denmark’s GDP. Indeed, it exceeds supply, and sales of it and its rival product from Eli Lilly are expected to top $15bn this year. Both companies are struggling to meet demand – surely the precursor of a very strong investment opportunity.

Strategic Expansions by Novo Nordisk and Eli Lilly: A Deep Dive into European Investments

In the dynamic landscape of pharmaceuticals, Novo Nordisk and Eli Lilly have embarked on ambitious strategic expansions, reflecting their commitment to addressing the pressing global concern of obesity. With a combined investment exceeding billions of euros, these pharmaceutical giants are self-confident to revolutionize production capabilities and advance the development of anti-obesity medications.

Novo Nordisk’s bold move to invest 2.1 billion euros in expanding its facility in Chartres, France, stands as a testament to the company’s dedication. Novo Nordisk, commanding a market capitalisation of approximately $460 billion and currently holding the title of Europe’s most valuable company, is renowned for its anti-diabetes drugs, particularly the widely acclaimed anti-obesity medication, Wegovy.

The primary objective is to double the size of the existing plant, significantly ramping up production capacity. This expansion is strategically positioned to meet the burgeoning demand for anti-obesity medications, particularly those targeting the GLP-1 hormone system.

Eli Lilly’s commitment of 160 million euros in its Fegersheim facility, located in Bas-Rhin, France, represents a strategic initiative to fortify its position in the anti-obesity pharmaceutical market. Insights into this investment reveal a focus on implementing a high-speed production line, a critical component in ensuring efficiency and agility in meeting the escalating demand for obesity treatments.

The high-speed production line is designed to streamline manufacturing processes, reducing lead times and increasing overall output. Eli Lilly’s strategic vision is clear – to position Fegersheim as a hub for the rapid production of anti-obesity medications, ensuring a timely and robust supply chain. This commitment not only reflects Eli Lilly’s dedication to innovation but also solidifies its presence in the competitive landscape of pharmaceuticals.

Beyond the French borders, Novo Nordisk and Eli Lilly have set their sights on broader European expansions. Novo Nordisk’s colossal 5.6 billion euros project in Denmark and Eli Lilly’s 2.3 billion euros investment in Germany showcase the scale of their ambitions. A comparative examination reveals the distinct approaches each company is taking to bolster their global footprint.

Novo Nordisk’s investment in Denmark is a strategic move to fortify its base on home turf. The project aims to significantly increase production capabilities in the company’s land of origin. On the other hand, Eli Lilly’s 2.3 billion euros investment in Germany _ set to become operational in 2027, this new facility aims to significantly increase the company’s worldwide parenteral (injectable) product and device manufacturing infrastructure. It is designed to meet the growing demand for Lilly’s medications, encompassing its diabetes and obesity portfolio _ signifies a commitment to establishing a robust manufacturing facility in a key European market. “This project once again proves how attractive Germany is as a business location” says German Trade & Investment (GTAI) CEO Robert Hermann. “It strengthens the German pharmaceutical sector, making it more resilient in terms of supply chains. In our opinion, it doesn’t get any better than a highly innovative global corporation investing in Germany and creating high-quality jobs. Both Germany and Europe will benefit from the products manufactured in Alzey”.

In April of last year, Eli revealed plans for additional investments totalling 1.6 billion US dollars in its two new manufacturing sites in Indiana, along with a 450 million US dollars expansion of a plant in North Carolina. This expansion was geared towards meeting the robust demand for its diabetes drugs. Cumulatively, the company has committed 6.4 billion US dollars between 2020 and 2023 to bolster its manufacturing capacity in the United States. This comparative analysis highlights the extensive global scope of the anti-obesity initiatives undertaken by these pharmaceutical giants.

Navigating the Regulatory and Ethical Landscape in the Pharmaceutical Boom: A Delicate Balance

The pharmaceutical boom in the anti-obesity sector has ignited not only excitement about innovative treatments but also a critical examination of the regulatory and ethical considerations governing this dynamic landscape. As Novo Nordisk and Eli Lilly spearhead significant investments, regulatory bodies like the Agence nationale de sécurité du médicament et des produits de santé (ANSM) play a crucial role in overseeing pharmaceutical investments and ensuring ethical practices. The regulatory body acts as a gatekeeper, ensuring that pharmaceutical advancements do not compromise patient safety or ethical standards.

Ethical Considerations of Off-Label Use: From Diabetes to Obesity

One ethical quandary in the pharmaceutical boom revolves around the off-label use of medications originally designed for diabetes treatment in the context of obesity. The GLP-1 drugs, initially formulated to address Type 2 diabetes, have found success in obesity management. However, the ethical considerations surrounding this off-label use raise questions about the appropriateness of repurposing medications for conditions they were not initially intended to address.

Healthcare professionals and regulatory bodies must carefully navigate these ethical waters, balancing the potential benefits of repurposed drugs against the need for rigorous testing and clear indications. Transparent communication with patients about the nature of off-label use, potential risks, and alternatives becomes paramount in upholding ethical standards in healthcare.

Balancing Profit Motives with Societal Health Needs: Collaborative Efforts

The intersection of profit motives and societal health needs forms a delicate equilibrium that demands collaboration between pharmaceutical companies and regulatory bodies.

Collaborative efforts between pharmaceutical companies and regulatory bodies become crucial in striking this balance. Open communication channels, regular audits, and shared objectives in promoting public health contribute to a harmonious relationship. The establishment of ethical guidelines, such as fair pricing practices and responsible marketing, ensures that profit motives do not compromise the overarching goal of enhancing societal well-being.

The World Health Organization (WHO)

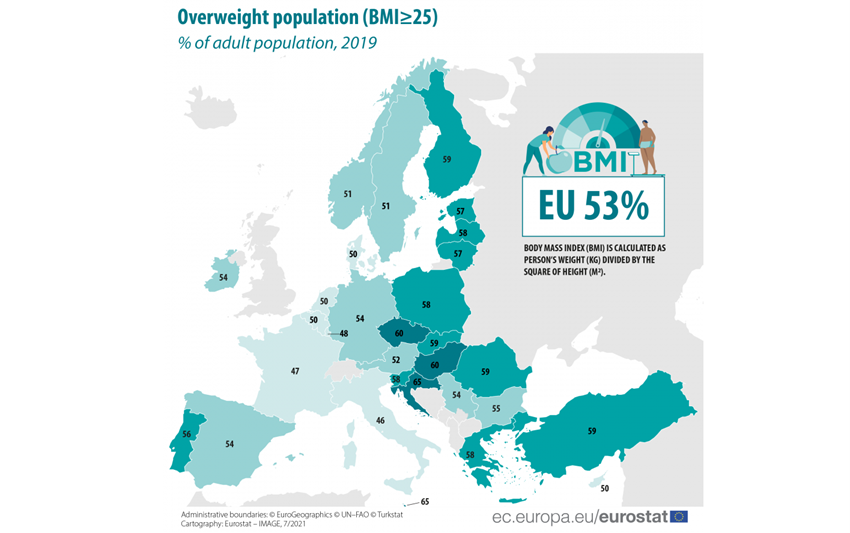

Overweight and obesity are defined by WHO as abnormal or excessive fat accumulation that presents a risk to health. A BMI over 25 is considered overweight, and over 30 is obese.

One in eight people are now living with obesity, says a recent article from WHO about a very serious study released the 1st of March 2024.

Worldwide, obesity among adults has more than doubled since 1990, and has quadrupled among children and adolescents (5 to 19 years of age).

More than 1 billion people in the world are now living with obesity, and today more people are obese than underweight in every region except the South-East Asia Region. Once considered a problem only in high-income countries, today some middle-income countries have among the highest prevalence of overweight and obesity worldwide.

Obesity is a serious public health problem as it significantly increases the risk of chronic diseases such as cardiovascular disease, type-2 diabetes, hypertension, coronary heart diseases and certain cancers. For specific individuals, obesity may further be linked to a wide range of psychological problems. For society as a whole, it has substantial direct and indirect costs that put a considerable strain on healthcare and social resources.

INCONCRETO, as an international consultancy, can provide expertise in capital project optimization in the pharmaceutical industry.

Connect with our people!

We combine technical expertise with large program execution practices, improving predictable outcomes and steering profitability on Capex/Opex project investments.

For further readings, you may consult these sources

- https://www.ftadviser.com/opinion/2023/11/09/what-opportunities-are-there-in-investing-in-anti-obesity-drugs/

- https://www.fool.com/investing/2023/12/21/weighing-their-chances-5-leading-healthcare-compan/

- https://www.euronews.com/business/2023/11/24/denmarks-novo-nordisk-invests-21-billion-in-france

- https://www.gtai.de/en/meta/press/us-pharma-giant-lilly-expands-in-germany-1053766

- https://www.who.int/health-topics/obesity#tab=tab_1

Newsletter

© INCONCRETO. All rights reserved. Powered by AYM