INCONCRETO NEWS

The role of biotechnologies in the European economy – Part II

The European biotech during the COVID-19 pandemic: preparing a brighter future

The powerful combination of technology and biology proved to be a unique asset in the fight against the expansion of COVID-19. Biotech especially in healthcare saw a critical acceleration in the entire continent.

Such a successful result was not so evident at the beginning of this unexpected and challenging pandemic. The European market fragmentation risked threatening the sustainability of the entire healthcare system, due to nationalistic approaches developed by each country. As Andrew Topen, chairman of EuropaBio, stressed in an interview with EURACTIV, “the crisis offered to the sector many learnings about these bottlenecks and their detrimental impact when it comes to the security of supply”. Bottlenecks inevitably led to short-term interruptions of medicines supplies, essential goods which became less available at the time.

On the other hand, after this initial lack of coordination, unprecedented scientific and industrial dialogues, not only within Europe but also at the worldwide level, led to the conception and delivery of effective COVID-19 vaccines at an unparalleled speed. The research and manufacturing sectors showed their readiness to shorten timelines significantly and drove positive innovation. Everywhere in Europe and the rest of the world, health and life science companies took action as never before, with an extraordinary focus on prevention, treatment and vaccination against the virus. Phases of clinical trials and drug approval became topics of conversation, giving biotech that public attention, which became means for new financial resources. More funds and capital were made available as investors began to see the value in this sector. In 2020 biotech initial public offerings hit record highs at $9.7 billion, and venture capital funding grew by 45% worldwide, with Europe’s mean funding size increasing at twice the rate.

The application of powerful computing and AI facilities, along with the necessary quick and in-real-time sharing of data across different geographies, gave a notable boost to the biotech industry in Europe. This boost accelerates the establishment of a common European digital space with a great potential to forge an ecosystem where innovative biology can not only enhance health but also tackle climate change. Since the sector ranges from rare diseases to improving our quality of life (including through agricultural and industrial uses), European biotech is a candidate to contribute to a healthier and better planet.

The concept of “bio revolution” presented in the 1st part of this publication is built around a double approach of collaboration and convergence. Capitalising on the interconnections established between biology and data analysis, AI and computing, Europe has the opportunity to foster its levels of digitalization and modernize all the traditional industries related to biotech, making them highly competitive.

Observers indicate the most impactful path for the future of European biotech: reinforcing the ecosystems through cooperation and innovative business models. In this framework, many small, science-based companies should be balanced by a few large groups to lead the commercialization of new biological technologies. Effective convergence will be guaranteed by partnerships and collaborations between science and technology players and biology-first technological platforms. The larger creation of interdisciplinary teams and the reinforcement of cross-disciplinary networks across research and academia can extremely foster the confluence of disciplines. By promoting cross-regional collaboration and knowledge sharing, including the creation of accessible pan-European scientific databases, European institutions and policymakers could facilitate this virtuous convergence.

The European biotech clusters: fully harnessing their potential towards innovation and competition

From the perspective of establishing this ecosystem, Europe can count on the strong basis represented by the high level of its research and academia. The entire continent shows a clear lead over China, the United States, and the rest of the world regarding the quality and quantity of its science.

Europe has world-class research institutions, medical centres, and hospitals that provide a solid basis for sourcing and developing scientific and clinical innovations. Analysing especially this field of biotech applied to healthcare, the Times Higher Education’s World University Rankings 2022 reveals that Europe is home to 42% of the world’s top 100 universities for life sciences and 31% of the top 100 for computer science.

The future of European biotechnologies depends on improving the translation of research into new companies, raising more capital, and building entrepreneurial talent.

However, such quality of universities and research is often at the core of robust European biotech clusters, already established within numerous countries in the European Union. Avenues for the success of European biotech industry should be built around these excellencies, with the involvement of companies and the facilitating support of public institutions.

In the next paragraphs, we will briefly present an overview of the geography of biotech clusters in Europe, focusing on the cases of France, Germany, Italy and Belgium, which are deeply proficient in life-sciences-related biotech.

France:

In the aftermath of the COVID-19 pandemic, the French government defined a new Health Innovation 2030 Plan, allocating 7.5 billion euros to an ambitious project to turn France into Europe’s health innovation leader by 2030. The various strategies and actions decided in this frame include creating biotech innovation hotspots, streamlining the organization of clinical trials, and simplifying the market access system for new treatments. With the introduction of new specialized programs like the Campus Biotech Digital, launched in April 2022, which is run by bioMérieux, Novasep, Sanofi, and Servier in close collaboration with Atos, IBM, and Microsoft, a strong accent is also devoted training, with specific programs that are conceived to cover every step of the bioproduction process.

France currently counts on seven main clusters in life sciences: the most important is Medicen, based in the Paris capital region, which brings together more than 510 health innovation players, including 430 healthtech startups and SMEs, health manufacturers, and the main national research and healthcare institutes. As part of the strategic plans for the near future, France recently launched the Paris Saclay Cancer Cluster (PSCC), founded by Sanofi, Gustave Roussy, l’Inserm, l’Institut Polytechnique de Paris et l’Université Paris-Saclay. Sanofi, as leader in biopharma, is highly contributing to this project: over the past twenty years, the group has transformed its R&D and production complex in Vitry-sur-Seine, repositioning it in biotechnology and oncology, and has invested 250 million euros there for the Biolaunch, the largest bioproduction plant in France.

Germany :

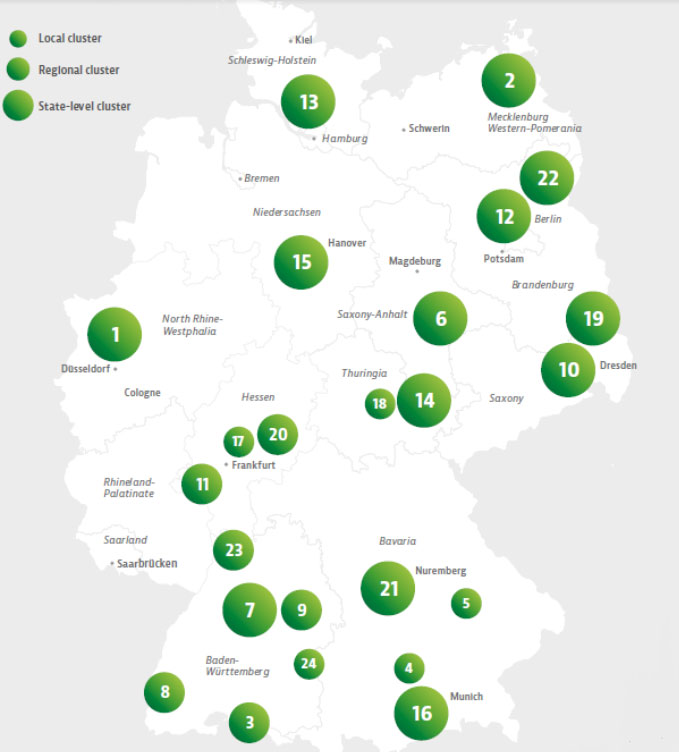

Germany has established 24 biotechnology clusters, which are classified at national, regional, and local levels. These clusters include technology parks and accelerators and organizations that operate within single districts but also in the entire country.

Biotechnology clusters in Germany

The BIO.NRW cluster, corresponding to the region of North Rhine-Westphalia, in the very centre of Europe, is the result of the intense cooperation between companies, research institutes, and the value-added chains in the most critical fields of biology and technology. Around 49% of the total revenue created by German biotechnology companies is generated in this area, which is also the European region applying for more patents in the biotechnology sector.

Over 500 life science enterprises, of which 112 companies with a designated focus on biotechnology, make North Rhine-Westphalia a leading European centre of innovation, whose scientific landscape in biotechnology is shaped by 56 universities and non-university research institutes and by more than 60 technology centres serving as incubators for start-up companies.

Italy:

During the hardest times of the COVID-19 pandemic, the Italian biotech industry resisted the crisis, recording as a whole only a 5% drop in the overall 2020 turnover, equal to less than half of the decrease of the overall Italian industrial sector. However, the R&D dedicated firms in biotech increased by 30% their turnover in 2020-2021.

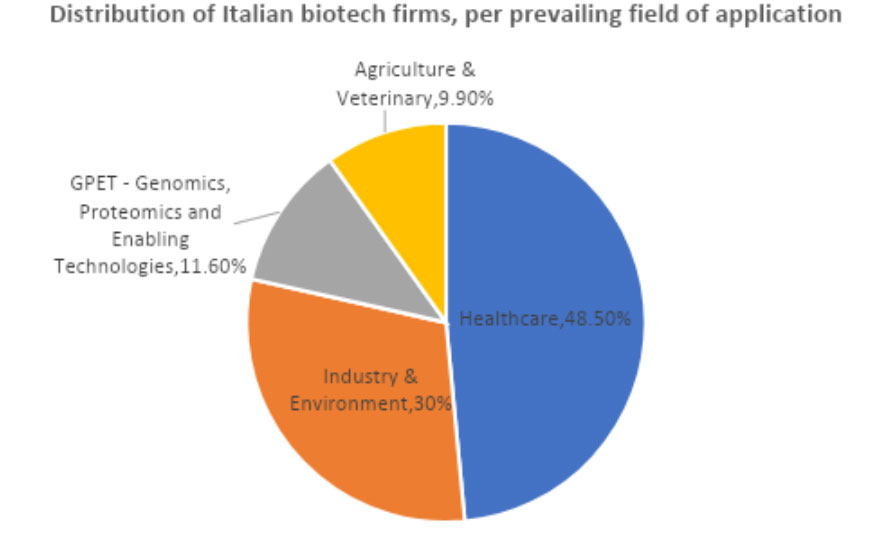

Italian healthcare-related biotech firms represent the largest share of Italian biotech companies. Still, we observe continuous growth (+29% between 2014 and 2021) in the number of companies active in the field of industry and environment, and especially in businesses operating in the agriculture and veterinary sectors (+35% in the same period).

Despite observing a growing distribution of the biotech industry all over the national territory, especially towards the southern and north-eastern regions (with the latter mainly active in industrial biotech), a strong territorial concentration is maintained. In fact, in 2021, 53% of Italian biotech firms were based in 4 regions: Lombardy, Latium, Emilia Romagna, and Piedmont.

Concerning the life science sector alone, figures indicate that at the national level Italy comprises 5.537 companies within the “Advanced Life Science in Italy” (ALISEI) cluster, with a value production equal to 225 billion euros and investments in R&D of 6.1 billion euros (accounting for 10% of Italian GDP).

Belgium:

In the last decade, culminated with the COVID-19 pandemic, Belgium has constructed a unique biotech ecosystem covering the entire value chain, from preclinical research for cutting-edge biotech production to the logistics platform for global distribution. In this period, the number of workers in biotech and biopharma has increased by 41%, from about 25,000 to more than 35,000. Moreover, R&D spending has increased by 166%, rising from 1.9 billion in 2010 to more than 5 billion euros in 2020. Over the years, strong biotech clusters have emerged, including those in Ghent, Charleroi, Leuven and Liège, where a strong collaboration is established between universities, research centres, hospitals, spin-offs and start-ups, SMEs and large international companies.

INCONCRETO, as an international consultancy, can provide expertise in capital project optimization and oversee critical paths for biotech project execution.

Connect with our team!

We combine technical expertise with large program execution practices, improving predictable outcomes and steering profitability on Capex/Opex project investments.

For further reading, you may consult these sources:

The future of biotech in Europe, by Euractiv

Europe’s emerging biotechs: Challenges, opportunities and funding, by DDW-online

What’s ahead for biotech: Another wave or low tide?, by McKinsey & Co.

Deciding on the right path How biotechs should expand in(to) Europe, by Deloitte

France’s grand plan to lead Europe’s biotech innovation landscape, by La Biotech

Biotechnology Clusters in Germany (Issue 2022/2023), by Germany & Trade Invest

BioInItaly Report 2022: The Italian biotech industry – Facts&Figures, by Assobiotec – Federchimica

The future of Belgian biotech: from ‘invented in Belgium’ to ‘made in Belgium’, by Essencia

Newsletter

© INCONCRETO. All rights reserved. Powered by AYM