INCONCRETO NEWS

Green hydrogen energy: powering the future through sustainability – Part II

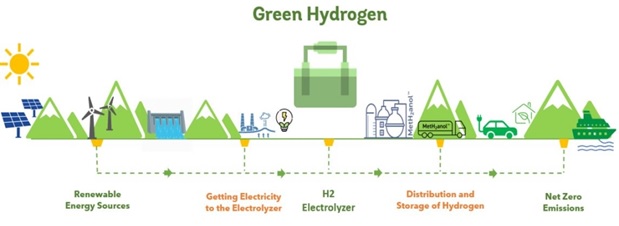

Hydrogen is defined as “green” when its production process is based on renewable energy sources –mainly through an electrolytic process.

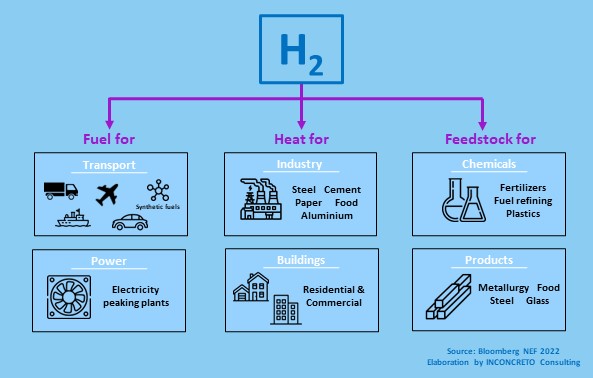

As a cross-cutting energy vector, green hydrogen is a strong ally for decarbonizing heavy industry, including chemical and energy-hungry sectors like steelmaking and cement production, as well as cleaning products, refrigeration, and electricity grid stabilization, and also some kinds of transports. It can also be converted into derivatives: by 2050, green hydrogen is projected to have a significant market share in several fields, such as green ammonia for fertilizers or synthetic fuels, contributing to mitigating greenhouse gas emissions.

Main challenges in using green hydrogen as a source of energy

When the choice to use hydrogen as a fuel is made, some disadvantages stand out. There are safety concerns since hydrogen, which is colourless and odourless and therefore lowly detectable, is highly flammable and volatile.

Major difficulties are unveiled when considering green hydrogen as a fuel. Hydrogen, whether green or not, is a gas that is difficult to handle. Due to its low volumetric energy density, it must be extremely compressed at high pressures to be packed into a tank in appropriate quantities to power a car.

A further challenge is transport – i.e., how to carry hydrogen to the refuelling stations to supply traveling cars. Hydrogen is extremely light and has low volumetric energy density, making it lighter than helium. Special pipelines are required to carry 2700 times less energy-dense hydrogen than gasoline, which is easily transferable through pipelines and shipping containers.

Finally, fuel from hydrogen is less advantageous than electric power for cars: it is currently cheaper to charge an electric vehicle than to refill on hydrogen.

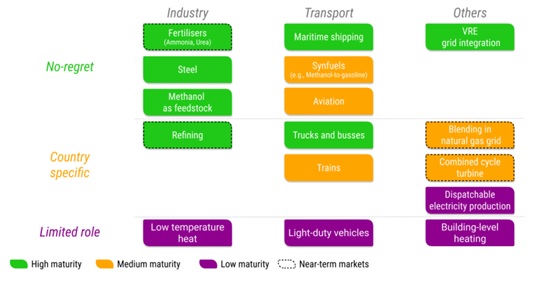

Hydrogen is proven less beneficial for light road transport: its impactful uses must be found elsewhere.

Green hydrogen’s added value: its potential applications towards decarbonization

Available decarbonization paths are narrow for sectors that are hard to lessen, like heavy industry, freight transport – especially shipping – and aviation. Heavy industry and long-distance transport modes, still dependent on fossils, currently emit around 7.0 and 4.0 gigatonnes of CO2 per year respectively, corresponding to 30% of total global energy-related CO2 emissions.

Here come green hydrogen and its derived products, which can genuinely play a key role in achieving the net-zero emissions goal. Application of green hydrogen is generally prioritised for hard-to-abate industry sectors whose processes have considerably high heat requirements, not fulfilled by other low-carbon alternatives.

In countries at advanced stages of enabler (VRE) implementation, green hydrogen is also considered to enhance electricity system flexibility, since it provides avenues for long-term storage, for instance through the production of synthetic fuels.

Another critical factor of green hydrogen deployment is scalability: opportunities vary depending on whether it is integrated into large demand centres in industrial regions or distributed across a specific country for multiple purposes. Nonetheless, experts observe that there is no one-size-fits-all roadmap, and current national strategies prove that green hydrogen choices vary according to local and national circumstances.

Matching the supply of green hydrogen with demand in no-regret usages can be challenging during markets’ creation and in the first phases of markets’ growth. While developing large-scale electrolyser capacity, shipping capacity and industrial facilities such as direct reduced iron (DRI) plants require 3 to 6 years, building the ports infrastructure, grid connection and geological storage require 8 to 15 years. Therefore, the key to success in deploying solid infrastructure for green hydrogen is to achieve sustained growth in volumes allowing progress in the learning curve. In this sense, the use of early market opportunities for developing green hydrogen production can be driven by the availability of facilities, the cost of incumbent practices and the exploitation of existing systems with minimal or no modifications.

These optimistic scenarios are reinforced by the fact that green hydrogen production costs are expected to decrease considerably in the next decade. A forecast built by Bloomberg New Energy Finance points out that, if costs continue to drop, green hydrogen could be produced for $0.70 – $1.60 per kg by 2050, a price competitive with natural gas.

Lower rates will be driven by the falling costs of renewable power and better learning curves in electrolysers due to capacity enlargements, constant innovation, and increased efficiency.

INCONCRETO, as an international consultancy, can provide expertise in capital project optimization in the energy sector.

Connect with our team!

We combine technical expertise with large program execution practices, improving predictable outcomes and steering profitability on Capex/Opex project investments.

For further readings, you may consult these sources:

Green Hydrogen: A key investment for the energy transition, by the World Bank

What is green hydrogen and why do we need it? An expert explains, by The World Economic Forum

Hydrogen as a fuel: the pros and cons, by Pirelli

Green hydrogen opportunities for emerging and developing economies – Identifying success factors for market development and building enabling conditions, by the OECD

Green hydrogen: the energy of the future essential for decarbonisation, by Acciona

Newsletter

© INCONCRETO. All rights reserved. Powered by AYM