INCONCRETO NEWS

Building Africa’s Self-Sustaining Vaccine Manufacturing Ecosystem: Challenges, Progress, and Collaborative Solutions

Empowering Africa’s Healthcare: Strengthening Local Medicine Production for a Resilient Future

The limited manufacturing capacity for diagnostics, therapeutics, and vaccines in Africa is a critical concern that necessitates immediate attention. The need to establish a self-sustaining ecosystem is evident. This challenge has catalysed partnerships between African governments, international health agencies, and private enterprises to establish state-of-the-art vaccine manufacturing facilities across the continent.

Imports continue to play a pivotal role in meeting the healthcare needs of the population, as challenges such as limited infrastructure, regulatory hurdles, and funding constraints persist. However, African nations have made commendable efforts to establish local pharmaceutical industries, aiming to enhance self-sufficiency and reduce reliance on external sources.

In most of sub-Saharan Africa, pharmaceutical imports comprise as much as 70 to 90 percent of drugs consumed. This dependence on imports leaves citizens vulnerable to shortages of medication — a problem that triggered a continent-wide crisis during the pandemic.

In Rwanda, small pharmacies and large medical stores ran out of stock. In South Africa, it became nearly impossible to fill prescriptions for psychiatric drugs and oral contraceptives. In Kenya, oncologists complained about challenges treating their cancer patients. And in Nigeria, stocks of anti-hypertensives and many other treatments to manage chronic illnesses, including HIV medicines, dipped critically low.

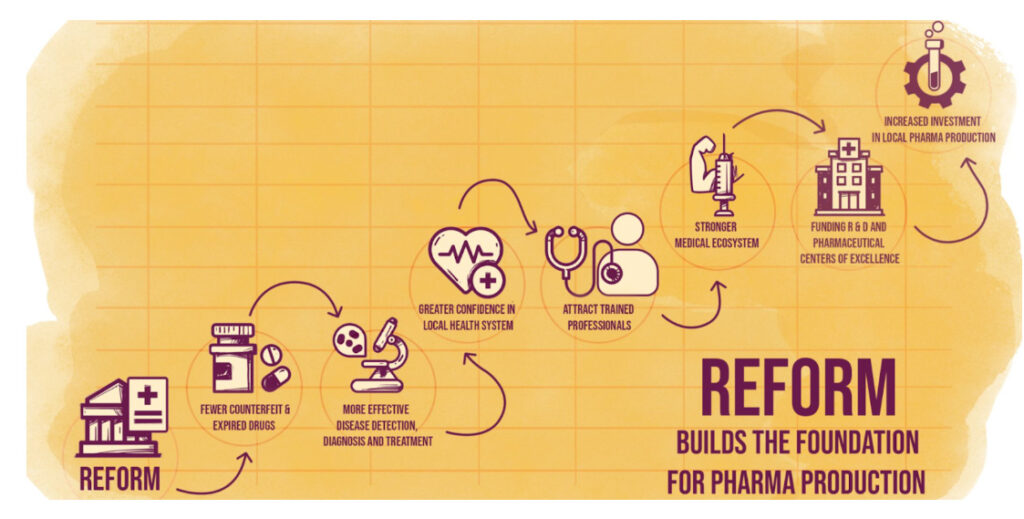

More local manufacturing of medications and active pharmaceutical ingredients could strengthen health systems throughout Africa. Moreover, investing in local production does more than bolster health security; it fosters economic growth, job creation, and the development of a skilled workforce.

Currently, Africa’s production of medicines stands at a crossroads, characterized by a delicate balance between domestic manufacturing and import dependency. While the continent has taken significant strides in bolstering its pharmaceutical capabilities, a considerable portion of its medicinal supplies still relies on imports.

To navigate this landscape, African governments and international partners are collaborating to strike a balance between local production and imports. Strategies include fostering investment in local manufacturing, improving regulatory frameworks, and promoting technology transfer. By harnessing these efforts, Africa aims to reshape its pharmaceutical landscape, gradually reducing its dependence on imports while strengthening its ability to provide essential medicines to its growing population.

The worldwide public health crisis has also captured the attention of investors who have noted the imbalance between supply and demand, said Frannie Léautier, CEO of SouthBridge Investments, a pan-African investment bank. Africa’s lack of essential medicines and APIs during the pandemic “had implications on the pharma and health sector in Africa over and above the direct effects of COVID-19” Since the crisis began, “a lot of thinking about the demand side has been happening at the country and regional level, and also among investors who want to bridge that gap for pharmaceutical products. Investors are looking at Africa with new eyes.”

The New York Times wrote on April 25th “Can Africa Get Close to Vaccine Independence? Leaders on the African continent have vowed that if there is another pandemic, they won’t be shut out of the vaccine market.” The World Health Organization revealed that only 3 percent of the total Covid-19 vaccine doses distributed worldwide in 2021 were allocated to Africa, despite the continent being home to one-fifth of the global population. Amid the glaring global vaccine inequity, Africa found itself disproportionately lagging behind amidst the pandemic, with limited negotiating leverage for vaccine contracts. Overall, the WHO analysis has shown that, as of 16 October 2022, just 24% of the continent’s population had completed their primary vaccination series compared with the coverage of 64% at the global level.

What Would it Take for Africa to Manufacture its own Vaccines?

Outbreaks of Ebola in 2014 and 2018, as well as the constant threat of Africa-specific diseases such as Lassa fever and Rift Valley fever, have kept the idea of local vaccine production in the forefront of world leaders’ minds. Developing the capacity for domestic manufacturing of vaccines holds numerous advantages: bolstering public health resilience during outbreaks, enhancing the response to Africa-specific diseases, improving readiness for future epidemics or pandemics, and yielding economic benefits such as reducing trade imbalances, enhancing the skilled workforce, and lessening foreign-exchange demands.

While countries like Brazil, India, and Indonesia have successfully established domestic vaccine industries, most African nations and businesses have been hesitant to venture into vaccine production due to factors like cost concerns, limited access to capital, demand uncertainty, and other challenges over the last decade. Nevertheless, current circumstances influenced by the Covid-19 pandemic are shifting the dynamics, potentially leading to change.

Four key factors are contributing to this shift:

- Growing Emphasis on Health Security: Leaders are recognizing the significance of health security as a pivotal element for Africa’s development, prompting calls for investments in vaccine manufacturing.

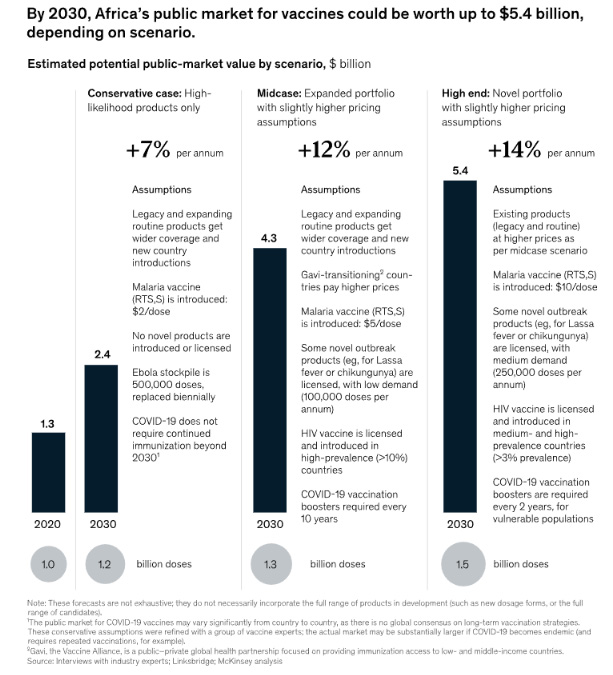

- Rising Demand: Anticipated growth in the African vaccine market, estimated to increase from $1.3 billion today to between $2.3 billion and $5.4 billion by 2030, is driven by a swiftly expanding population, persistent immunization gaps, and the introduction of new vaccines like those for Lassa fever and malaria.

- Evolving Economics through Technology: Advances in vaccine development and manufacturing processes, including innovations such as small-scale disposable technologies and high-density bioreactors, could potentially offset higher production costs in Africa, making it a more viable option.

- Supportive Environments: Increasing political and regulatory backing for vaccine manufacturing within Africa, exemplified by commitments from local and global leaders and initiatives like the African Continental Free Trade Area (AfCFTA) and the African Medicines Agency (AMA), are contributing to a more favorable environment for building a sustainable vaccines industry.

Towards a Vaccination Revolution: Collaborative Efforts and Promising Partnerships for Africa’s Health Security

Creating a self-sustaining vaccines industry in Africa is indeed a feasible goal, according to discussions with manufacturers, global health entities, and NGOs. However, this requires meaningful collaboration and a long-term (five- to ten-year) commitment from public, private, and social sectors. While challenges exist, they are surmountable. A successful outcome hinges on addressing technical skill gaps, which are particularly relevant in transitioning from small-molecule manufacturing to vaccines, and overcoming other obstacles. It will demand substantial effort and commitment, but the possibility of achieving this transformation is real.

The African Union has set a goal of having 60 percent of all vaccines used on the continent produced in African nations by 2040 – up from 1 percent now. The Africa Centers for Disease Control and Prevention says the continent’s existing vaccine market is worth an estimated $1.3 billion and is expected to grow to about $2.4 billion by 2030. But many who work in global health say buyers will have to pay a “resilience premium” — a higher price for African-made vaccines, the production of which helps build up the African industry. There is a lot less clarity about who is going to be willing to pay that higher price.

The obvious candidate is the Vaccine Alliance (Gavi), the organization that uses funds donated by high-income countries and major philanthropies to purchase routine and emergency vaccines for low- and middle-income countries. Gavi buys half the vaccines used in Africa today. Aurélia Nguyen, Gavi’s chief program strategy officer, says the organization is ready to sign advance purchase contracts with new vaccine makers in developing countries, to assure business owners of an income stream that will defray investments in expansion.

In May 15 2023, the African Union Commission (AUC) and Gavi signed a Memorandum of Understanding (MoU) to increase access and accelerate the uptake of life-saving vaccines across African Union member states towards supporting immunisation, providing technical and learning assistance and health systems strengthening. The partnership builds on the historic Addis Declaration on Immunization (ADI), which aims to ensure that everyone in Africa – regardless of who they are or where they live – receives the full benefits of immunization. It includes 10 commitments to increase political, financial and technical investments in immunization programs. The evolving direction of this partnership is bound to accelerate the attainment of health security as premised in the AU Agenda 2063 and the New Public Health Order (NPHO).

Unlocking Potential: Driving and Overcoming Challenges in Vaccine Manufacturing (based on BCG study)

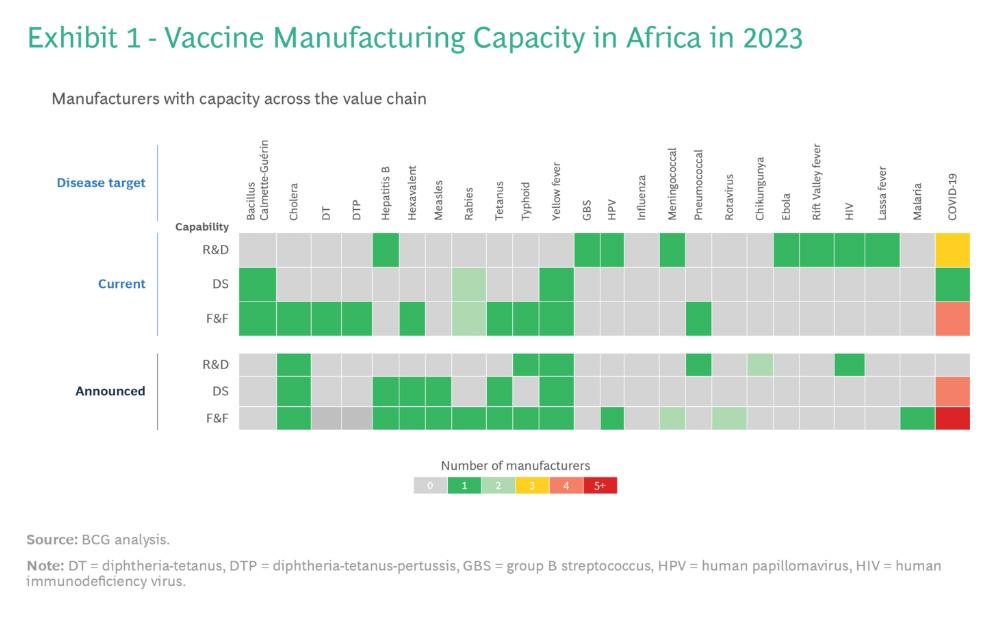

The African vaccine manufacturing sector is in its early stages. Acknowledging the need for further progress, the Partnership for African Vaccine Manufacturing (PAVM) proposed a strategy to establish a vaccine manufacturing ecosystem capable of meeting the 60% target. The plan involves 22 priority products manufactured across 23 facilities. Africa can tap into the capabilities of its 13 operational vaccine entities. Among these, eight offer fill and finish (F&F) capacity, five can produce drug substances, and three engage in research and development, currently producing vaccines for six antigens.

However, if all proposed projects become operational, F&F capacity would surpass the 2040 PAVM goals by over 60%. A similar trend is observed for drug substance manufacturing, more than doubling the 2040 targets. This misalignment results in potential excess doses of certain vaccines and ongoing shortages of others.

To facilitate effective scaling of vaccine manufacturing in Africa, three interlinked criteria must be met: a sustainable business model, production of appropriate vaccines in sufficient quantities, and support structures.

To establish a robust business model, stakeholders play a vital role in fortifying manufacturers’ strategies. Key components include:

- Advance Purchase Agreements (APAs): Governments should offer APAs to aid manufacturers in securing funding, expanding capabilities, and attracting partners for technology transfers. However, these agreements must extend beyond local markets and operate at the continental level to ensure sustainable demand.

- Financial Support Mechanisms: A mechanism is needed to subsidize African vaccine manufacturing in the medium term, whether through operational funding or agreements for price premiums per dose. Funding sources could include governments, donors, or a combination of both.

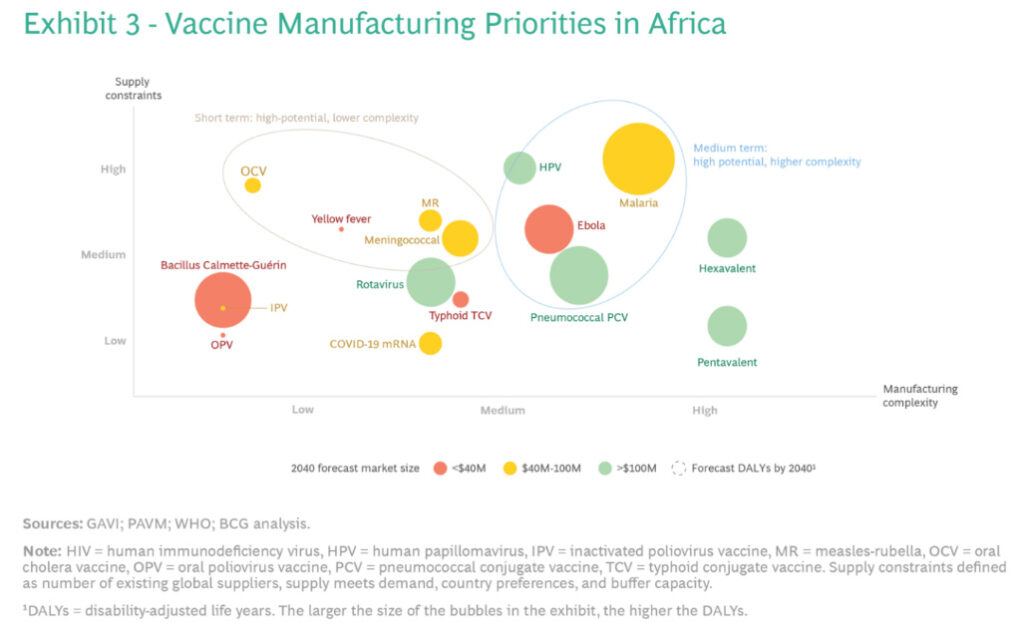

Stakeholders should identify vaccines with high supply constraints and low manufacturing complexity for short-term focus. These could include vaccines for rotavirus and meningitis. Determining suitable vaccines requires analyzing global supply, demand, ease of production, and platform compatibility. Companies should also develop F&F capabilities for more complex, supply-constrained vaccines in the long term.

While no single solution exists for the challenges faced by African vaccine manufacturers, establishing a comprehensive manufacturing ecosystem is crucial. This ecosystem will enhance vaccine supply security, address endemic diseases, bolster global pandemic readiness, and promote socioeconomic development on the continent. Collaborative efforts from all stakeholders are necessary to turn the vision of a robust African vaccine manufacturing ecosystem into reality.

INCONCRETO, as an international consultancy, can provide expertise in capital project optimization and oversee critical paths for biopharmaceutical project execution.

Connect with our team!

We combine technical expertise with large program execution practices, improving predictable outcomes and steering profitability on Capex/Opex project investments.

For further readings, you may consult these sources:

- https://www.ifc.org/en/stories/2021/africa-pharma-manufacturing-hubs-en, by International Finance Corporation (IFC), World Bank Group

- https://www.nytimes.com/2023/04/25/health/africa-vaccine-independence.html, by The New York Times

- https://www.afro.who.int/news/key-lessons-africas-covid-19-vaccine-rollout, by the World Health Organization (WHO)

- https://au.int/en/pressreleases/20230515/signing-new-agreement-drive-vaccine-impact-africa, by African Union

- https://www.mckinsey.com/industries/life-sciences/our-insights/africa-needs-vaccines-what-would-it-take-to-make-them-here, by McKinsey & Company

- https://www.bcg.com/publications/2023/ramping-up-vaccine-manufacturing-in-africa, by BCG

Newsletter

© INCONCRETO. All rights reserved. Powered by AYM