INCONCRETO NEWS

The European Strategy on Renewable Energy – Part II

European sustainable mobility: the European market of electric vehicles

Framing a European vision for electric vehicles

We have said it before, the European Union’s bold goal is to be the world’s first climate-neutral continent by 2050, as outlined in the European Green Deal. This set of measures aims to modernize the EU, increase resource efficiency, and enhance competitiveness.

Easy to say, quite complex to put in place. Such an objective implies not only the harmonic collaboration among all European countries but also the deployment of a bunch of structural modifications within European industry and at all levels.

The transport sector is increasingly playing a crucial role and is already at the heart of European policies. Real actions are being taken to speed up the transition. This implies that new types of vehicles will be privileged in the near future, but the process is already underway.

In October 2022, the European Parliament and the Council of the European Union agreed on the initial proposal from the European Commission about deploying sustainable mobility. The trilogues established that all new cars and vans registered in Europe will be zero-emission by 2035. As an intermediary goal towards zero emissions, the new CO2 standards will also require average emissions of new cars to come down by 55% by 2030 and new vans by 50% by 2030.

This agreement marks the first step in the adoption of the “Fit for 55” legislative proposals (the European plan for a Green Transition) submitted by the Commission in July 2021. It was presented right ahead of COP27 as a flagship for the EU’s domestic implementation of its international climate commitments.

Very special attention is devoted to the market of electric vehicles (EVs). Since 2020, the European Commission has been seeking to have at least 30 million electric vehicles on its roads by the end of the decade, increasing from a starting point of around 1 million EV driven in the continent then.

The European Commission estimates that increased production and sale of zero-emission vehicles will lead to more affordable models and to lower energy expenditure for consumers. On the other hand, for the European automotive industry, it would mean greater innovation in zero-emission technologies, strong industrial leadership and competitiveness, and more jobs developing and manufacturing new technologies, including in electrification, batteries, charging, and software.

Moreover, the European strategy goes in the direction of ensuring that, while leading by example for all the other countries all over the world, the European Union is capable of progressively and rapidly reducing to zero its production of fossil-fuel vehicles – and that not just for its domestic market, but also for avoiding any possible export of these polluting cars.

As Frans Timmermans, Executive Vice-President of the European Commission leading the European Green Deal, recently declared “continuing to produce combustion-engine cars for other countries is not the answer either. The transition to electric mobility may be slower in other parts of the world, but the electrification of entire economies is now becoming part and parcel of our international climate diplomacy. I would rather see the European industry export clean cars and clean technologies, and work on developing off-grid charging options, so that we help accelerate the green transition elsewhere”.

The diffusion of electric vehicles in the European countries

Over the years, electric cars, which include battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), have slowly but progressively gained importance in the European market.

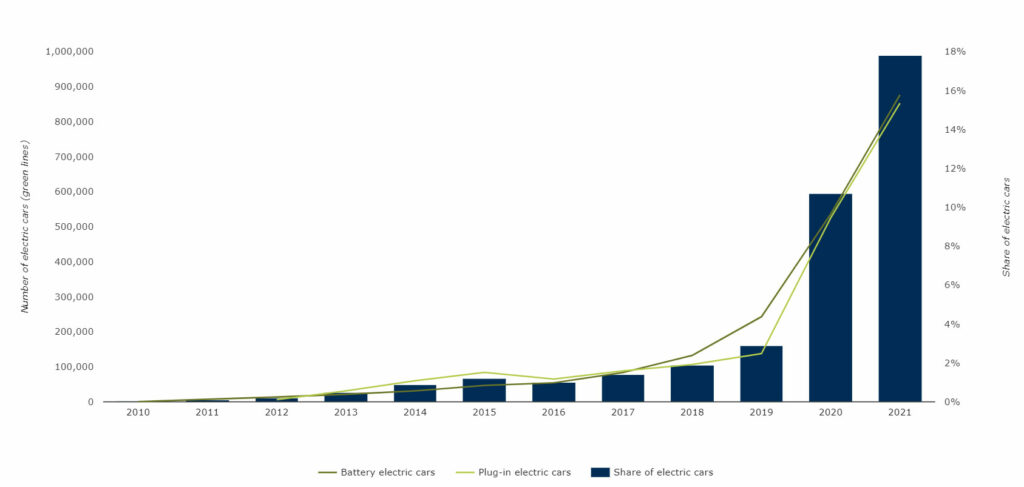

There has been a continuous increase in the number of new electric car registrations: records indicate that they were 600 in 2010 and became 1,061,000 units in 2020, accounting for 11% of new registrations. During the Covid-19 pandemic, when the overall automotive market particularly suffered and recorded massive losses in sales, electric car registrations rose to almost 18% of newly registered passenger cars. BEVs accounted for 9.0% of total new car registrations in 2021, while PHEVs represented 8.8%.

New registrations of electric cars, EU-27

According to the European Environment Agency, in 2021, the highest share of electric vehicles (BEVs and PHEVs) in national new car registrations increased in all European countries, as well as in Iceland and Norway, compared with 2020. The highest shares were found in Norway (86%), Iceland (64%), Sweden (46%) and Denmark (35%). With about 63% of BEV registrations, Germany, France and Norway were the first countries in the ranking. However, in some other European countries, the BEV registrations percentage remained around 1% of the total fleet (Cyprus, Poland, Czechia and Slovakia).

Concerning PHEVs, their percentage sales were highest in Iceland (36%), Sweden (25%) and Norway (22%).

Additionally, non-plug-in hybrid electric cars represented 19% of new registrations in 2021, a 7% increase since 2020. Even if they combine a conventional internal combustion engine with an electric propulsion system, these vehicles are exclusively fuelled by traditional fuels. Therefore, despite not being the solution or the key to achieving the European goals, their contribution to the decarbonization of European transport can still be adequate in accompanying the transition.

Over the years, the leading countries in electric mobility extended specific financial subventions such as tax reductions and exemptions for electric vehicles, with the aim to ensure an appreciation of these vehicles by their citizens. In this sense, since the country offers some of the highest subsidies in Europe, Germany represents the largest market in terms of EVs sold, where electric cars accounted for 25% of new cars sold overall. Moreover, between 2020 and 2021, the critical driver underpinning EV growth in Europe has been the newly established tightening CO2 emissions standards.

Over the 2016-2021 period, EV sales in Europe increased by a compound annual growth rate (CAGR) of 61%, the world’s highest recorded, right above China (58%) and the United States (32%).

Focusing more specifically on the new electric car sales within the European countries in 2021, the highest market share in Europe were Norway (86%), Iceland (72%), Sweden (43%) and the Netherlands (30%), followed by France (19%), Italy (9%) and Spain (8%).

As in previous years, new sales were almost equally split between BEVs and PHEVs, in contrast to China where BEVs typically score a clear lead.

The industrial actors: main players and their challenges

Automakers have been studying plans for new electrified models and for their distribution on the market to comply with policy regulations established within the European Union (and in many other countries), and to ensure and maintain a competitive position. Most of them, in Europe and in the rest of the world, have already fixed their goals for a fully electric future.

Now they have a significant challenge consisting of transforming these ambitions into reality, anticipating the development of a broader range of models and more competitive pricing, to respond to consumers’ demands.

The path risks to be fraught with various potential pitfalls, and that is not only in terms of industrial advancements.

First, the electric vehicles’ primary source of functioning is electric batteries. According to the European Institute of Technology (EIT), the European Union has a solid capacity to produce batteries competitively on its territory because there is a common willingness to make electric cars, from car manufacturers to financial players. The biggest challenge to overcome remains extraction and recycling, remaining sustainable through these processes.

Second, there is a concrete warning coming from the fact that electric vehicles need the installation of an innovative and interconnected infrastructure of charging stations, which must be deployed in all European countries. In addition, there still are an uncertain electricity supply and an unstable electric grid.

Third, as the study “New EV entrants disrupt Europe’s automotive market” conducted by McKinsey points out, new players coming from Asian countries are emerging with innovative go-to-market strategies and customer engagement models, which could potentially reshape the European market of electric vehicles.

In this framework, the action of the European Institute of Technology remains key. Its skilling programs and the projects conducted on the field with start-ups and companies in all the steps related to the production and deployment of electric vehicles are concrete drivers allowing to ensure that the European goals for sustainable mobility are achieved.

INCONCRETO, as an international consultancy, can provide expertise in capital project optimization in the energy sector.

Connect with our team!

We combine technical expertise with large program execution practices, improving predictable outcomes and steering profitability on Capex/Opex project investments.

For further reading, you may consult these sources:

First ‘Fit for 55’ proposal agreed: the EU strengthens targets for CO2 emissions for new cars and vans, by the Council of the European Union

Europe’s car industry must look to the future, not the past, by Vice-President Frans Timmermans, on Euractiv

Electric Vehicles, by the International Energy Agency

New registrations of electric vehicles in Europe, by the European Environment Agency

Global EV outlook 2022 – Trends in electric light-duty vehicles, by the International Energy Agency

Karine Vernier (EIT InnoEnergy) : « L’Europe aura besoin de 800 000 personnes dans l’industrie de la batterie », by Alliancy

New EV entrants disrupt Europe’s automotive market, by McKinsey & Co.

Why the automotive future is electric, by McKinsey & Co.

Newsletter

© INCONCRETO. All rights reserved. Powered by AYM