INCONCRETO NEWS

Green hydrogen energy: powering the future through sustainability – Part III

Aspiring strategies for the development of green hydrogen: targets and concrete actions

As of today, over 30 governments have developed, or are in the process of developing, national hydrogen strategies to facilitate their climate action plans and to take advantage of the social and economic co-benefits offered by the green hydrogen value chain.

Some policies are illustrative of this commitment:

| Country | Initiative | Year |

| Japan | Basic Hydrogen Strategy | 2017 |

| Australia | National Hydrogen Strategy | 2019 |

| European Union | A hydrogen strategy for a climate-neutral Europe | 2020 |

| Chile | National Green Hydrogen Strategy Call for Financing of Green Hydrogen Projects 2020 | 2020 2021 |

| Morocco | Green Hydrogen RoadmapGreen Hydrogen Strategy | 2021 |

| India | Green Hydrogen / Green Ammonia Policy | 2022 |

| South Africa | South Africa Hydrogen Society Roadmap | 2022 |

| Argentina | 2030 National Low-Emission Hydrogen Strategy | 2022 |

| United States | National Clean Hydrogen Strategy and Roadmap | 2022 |

The U.S. and the EU leading the way with visionary ambitions

The U.S. currently produces around 10 million tons of grey H2 per year. As part of its most recent National Clean Hydrogen Strategy and Roadmap, published in October 2022, the US plans to achieve an overall production of 50 million tonnes of green hydrogen per year by 2050. Interim targets have been established, up to 10 million tonnes by 2030 and 20 million tonnes by 2040 – which will mean a fundamental positive shift from “nearly zero” today.

On the other side of the Atlantic Ocean, since 2020 the European Union has established aspiring targets for green hydrogen, willing to generate important socio-economic and environmental benefits (including 5.4 million jobs, according to some analysis). The vision defines each step for turning green hydrogen into a viable solution to decarbonise different sectors over time, installing at least 6 GW of renewable hydrogen electrolysers by 2024 and 40 GW of renewable hydrogen electrolysers by 2030, before achieving complete maturity by 2050.

The European Union is also setting the regulation framework supporting the creation of early markets for green steel. In fact, the promotion of green hydrogen’s industrial consumption as a sustainable substitute for grey hydrogen could be a unique driver for heavy industry and transport. Manufacturing companies could label their products as “green” and sell them to customers accepting a possible premium. In automotive, for example, customer pressures and improved practices in terms of social corporate responsibility may be major drivers for the adoption of green steel supply.

Creating hydrogen valleys

Due to the characteristics of green hydrogen, it is essential to capitalise on multiple contributions from larger regions to exploit its potential. This is how a new concept was created in recent years: “hydrogen valleys”, whose aim is to overcome the limitations of individual projects by building hubs and clusters.

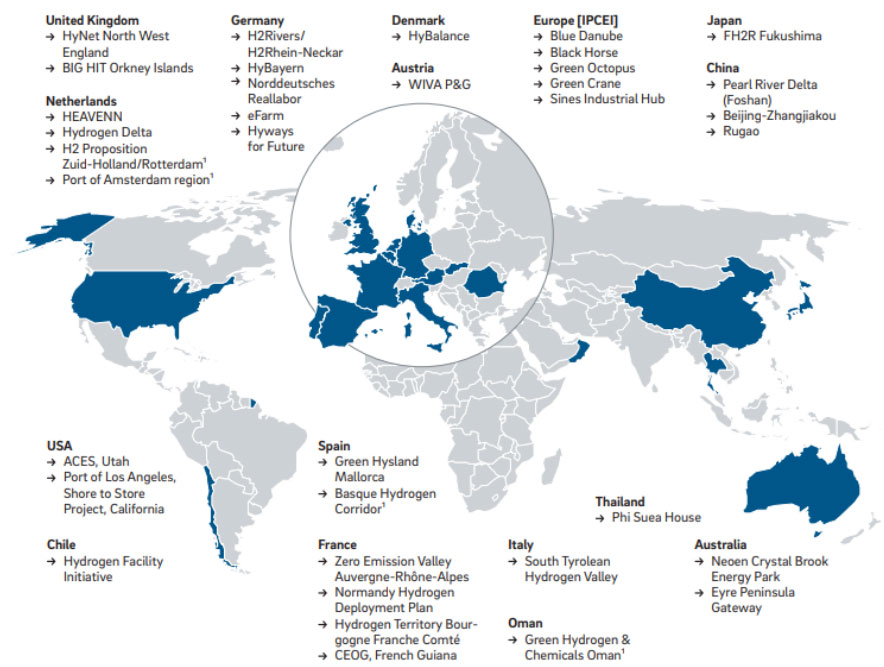

Eleven countries in Europe, four in Asia, two in South America, the United States and Australia have identified something like 30 hydrogen valleys – with a cumulative investment volume of more than EUR 30 billion – to cover multiple steps of the hydrogen value chain. Combining various uses within the same area (e.g. an industrial cluster, a port or a city) can create synergies, help achieve economies of scale, optimise costs and reduce demand variation.

Therefore these “valleys” give the opportunity to showcase the versatility of hydrogen by supplying more than one end-sector or application in the mobility, industry and energy sector.

New opportunities of hydrogen trade for both developed and emerging economies

Beyond the concept of hydrogen valleys, built around the advantages of proximity, cross-border cooperation and hydrogen trade between developed and emerging economies is also a strong option.

The example of Germany is telling: the country estimates a total hydrogen demand of around 90-110 TWh per year by 2030, but its available renewable energy resource potential falls short of this demand. Therefore, bilateral discussions have been initiated with various countries, including Angola, Morocco, Namibia and Turkey, to explore hydrogen imports through international gas pipelines or in the form of hydrogen-derived products.

For importers like Europe, beyond helping diversifying energy sourcing, green hydrogen can also mitigate geopolitical risks.

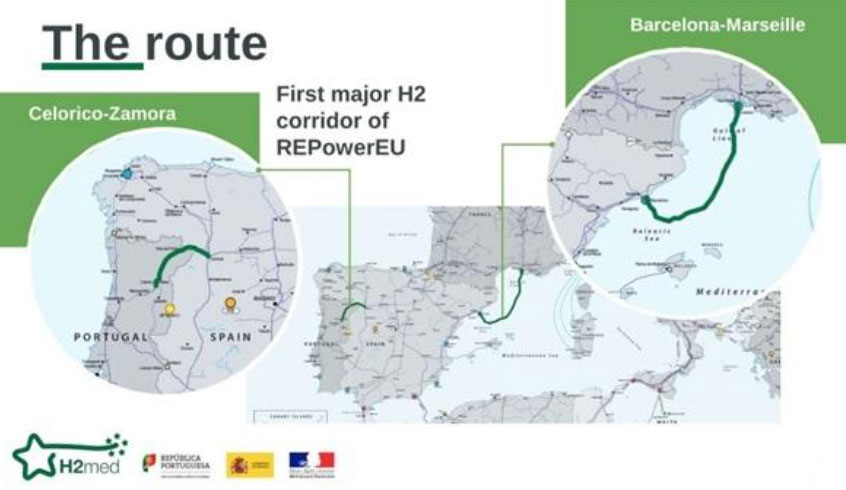

In order to facilitate the integration of green hydrogen in the European industry – and as part of the €210 billion RePowerEU plan for speeding up the energy transition after the beginning of Russia’s war in Ukraine –the European Union recently launched the H2MED project.

Agreed between the leaders of France, Portugal and Spain in December 2022 and expected by 2030, this initiative will lead to the construction of a new undersea pipeline exclusively dedicated to the transport of hydrogen, contributing to secure green energy autonomy to the entire European Union.

INCONCRETO, as an international consultancy, can provide expertise in capital project optimization in the energy sector.

Connect with our team!

We combine technical expertise with large program execution practices, improving predictable outcomes and steering profitability on Capex/Opex project investments.

For further readings, you may consult these sources:

- Green hydrogen opportunities for emerging and developing economies – Identifying success factors for market development and building enabling conditions, by the OECD

- The green hydrogen economy, by PWC

- Why such a focus on a US hydrogen strategy against the climate crisis?, by Hydrogen Fuel News

- Hydrogen roadmap for sustainable path to Euro energy transition, by Science Direct

- Hydrogen Valleys. Insights into the emerging hydrogen economies around the world, by Clean Hydrogen Partnership

- Hydrogen pipeline between Spain and France to be complete by 2030 and cost €2.5 billion, by Euronews

- The Role of Hydrogen in ASEAN’s Clean Energy Future, by the National Bureau of Asian Research

Newsletter

© INCONCRETO. All rights reserved. Powered by AYM