INCONCRETO NEWS

Pharmaceutical Renaissance: Shaping the Evolution of the Industry Landscape in Northern Europe

Dynamism and vision are prominent assets of Northern Europe. Denmark, Finland, Iceland, Norway, and Sweden commonly compose this region: historically connected, these countries are land of solid innovation and wide-ranging creativity.

They demonstrate strong economic prowess, acting as catalysts for digital advancements and tech-intensive innovation. According to the international consulting group Nordic Embassy, with a combined population of 27 million and a GDP of USD 1,5 trillion, the Nordic region is ranked as the 5th largest economy in Europe and the 10th largest in the entire world: even if it represents about 5% of the total population in the European Union, it is capable of delivering almost 10% of the total GDP.

Overall, around 20% of the population is estimated to be over 65 years old, and forecasts indicate that this percentage will grow up to 25% by 2040. Therefore, Nordic countries typically rank highly in life expectancy, reflecting the efficacy of their healthcare systems. As per the latest OECD data collected in 2023, the average life expectancy is very high here: 82.6 years in Norway, 83.1 in Sweden, 81.3 in Denmark, 81.2 in Finland, and 82.1 in Iceland.

Welfare advancements and equity are well-known and offer a cost-efficient and inclusive health model: healthcare is universally available and state-covered, being mainly publicly financed through taxes with minor private health care sectors and limited private medical insurance.

Thanks to the effectiveness of their systems, the Nordic countries happen to possess some of the most comprehensive health data registers globally. Even if the potential of joint research is not fully exploited, as highlighted in a recent study published by Aarhus University Hospital, the Nordic registries share common features. They provide population-based, routine, and prospective data on individuals lives and health with virtually complete follow-up and exact censoring information, being therefore a valuable resource for medical research and a crucial asset for medical development.

In such a vibrant landscape, multiple avenues exist for research, development, and commercialization of new medical drugs. If today the region can rely on some of the largest pharmaceutical groups of the world, such as AstraZeneca and Novo Nordisk among others, the reasons lie in the robust rise of biotech and medtech industry initiated at the end of the 20th century, when universities and research started fostering innovation.

As underlined by Clustermarket, in the last two decades, the Nordic countries have collaboratively invested in research and development, leading to a rise in startups and spin-offs in the biotech and pharma sectors.

The synergy between academia and industry is crucial in fostering knowledge transfer and talent development, establishing the groundwork for growth. These stakeholders are contributing to the creation of a promising future. The Nordic countries are potentially providing new forms of personalised healthcare, thanks to the development of advanced therapies, such as gene and cell therapies, and precision medicine. Digitalization is set to be included into healthcare solutions, ensuring improved patient outcomes, and streamlined processes.

Green capital projects and the integration of ESG criteria in the construction of new investments can potentially be favoured by sustainable initiatives within the biotech and pharma sectors, fostering the development of eco-friendly production methods and reducing the industry’s carbon footprint.

In this framework, the Nordic Pharmaceutical Forum (NPF), representing Finland, Iceland, Norway, Sweden, and Denmark, states that its joint tender agreement not only guarantees lower prices and supply security, but also contributes to the region’s progress in environmental initiatives by incorporating environmental requirements, especially in the tendering process for older, off-patent pharmaceuticals.

Medicon Valley: the Driving Role of Sweden and Denmark within the Region

Some hubs are particularly emblematic. As an example, in Sweden, Gothenburg hosts Scandinavia’s largest university hospital, leading in terms of business R&D and as an important hub for life science sector, while Uppsala University was ranked as 23rd in the world for Pharmacy & Pharmaceutical Sciences in 2023, thus reflecting the strong talent base the country has throughout its life sciences sector.

More widely, it is at the gateway to Denmark and Sweden that stands the beating heart of the life sciences industry and pharmaceutical manufacturing in the entire Scandinavian region. With 65,500 employees in these fields across around 1,150 companies and 14,600 university researchers spread across nine universities, Medicon Valley perfectly reveals how the virtuous proximity of universities, hospitals, and life sciences companies can drive innovation and boost the economy of the respective countries.

The strength of Medicon Valley is confirmed by its large number of life sciences patents: it is calculated the 67% of all the ones issued from Denmark and Sweden are completed here. Likewise, the volume of life sciences publications more than doubled since 1996, reaching almost 11,000 in 2021.

Medicon Valley proved to be successful in attracting some Global R&D pharmaceutical groups – Ferring, McNeil, Novo Nordisk, Lundbeck and LEO Pharma – as well as large pharmaceutical companies, such as Atos Medical, BioGaia, Cellavision, Chr.Hansen, Ferring, Genmab, Hemocue, LEO Pharma, Lundbeck, McNeil, Novo Nordisk, Polypeptide and Probi.

Solid world-class research is deployed here, notably in three areas: cancer research, conducted by about 600 researchers at the hospitals in Region Skåne, Region Hovedstaden and Region Sjælland, as well as the universities, in the industry and at the Danish Cancer Society’s research institute in Copenhagen; diabetes research, whose centres are established on both sides of the Øresund, and many of the largest players have joined forces in the Interreg-collaboration DiaUnion; reproduction research also traditionally strong in the Øresund Region.

Revolutionizing Pharma: a Cluster of Strategic Investments

The vital environment of Scandinavian life science industry is piloted by crucial investments. In fact, as emphasised by Politico, in the Nordic countries, it is the combination of government funding for research, a cooperative network of universities and hospitals, and the collaboration with larger companies in the field that is paving the way for the future success of the entire industry.

Government support is decisive in this regard: focusing again both on Denmark and Sweden, these countries have dedicated life science strategies and allocate over 3% of their GDP to research and innovation, one of the highest scores in terms of per capita R&D expenditure.

Investments are yielding very positive results. Politico highlights that research carried out by SwedenBIO, the industry group encompassing biotech companies in Sweden, indicates a notable presence of early-stage biotech firms in the country. Sweden holds the fifth position in Europe for the number of medicines under research, surpassing larger countries with established sector presence, including the Netherlands and Italy. A significant majority (around 80%) of these entities are emerging companies with fewer than 10 employees. Additionally, more than half of them stem from spin-offs of academic research institutes, because of the entrepreneurial culture of the Nordic region, which actively fosters innovation, transparency, knowledge sharing, and flat organizational hierarchies.

In 2013, Sweden faced a significant setback with the departure of its major pharmaceutical company, AstraZeneca, which decided to relocate its research headquarters to Cambridge, UK, and to transform into an Anglo-Swedish group. Following this announcement, the Swedish government intervened to ensure the preservation of the pharmaceutical ecosystem. AstraZeneca’s extensive former R&D headquarters, situated in Södertälje near Stockholm, found new purpose by providing space for start-ups. Among these ventures is reported the example of Anocca, focused on developing advanced technology for modifying the genetic code of immune cells to target tumours: it gained access to AstraZeneca’s former facility but also received financial support for its renovation and a period of reduced rent.

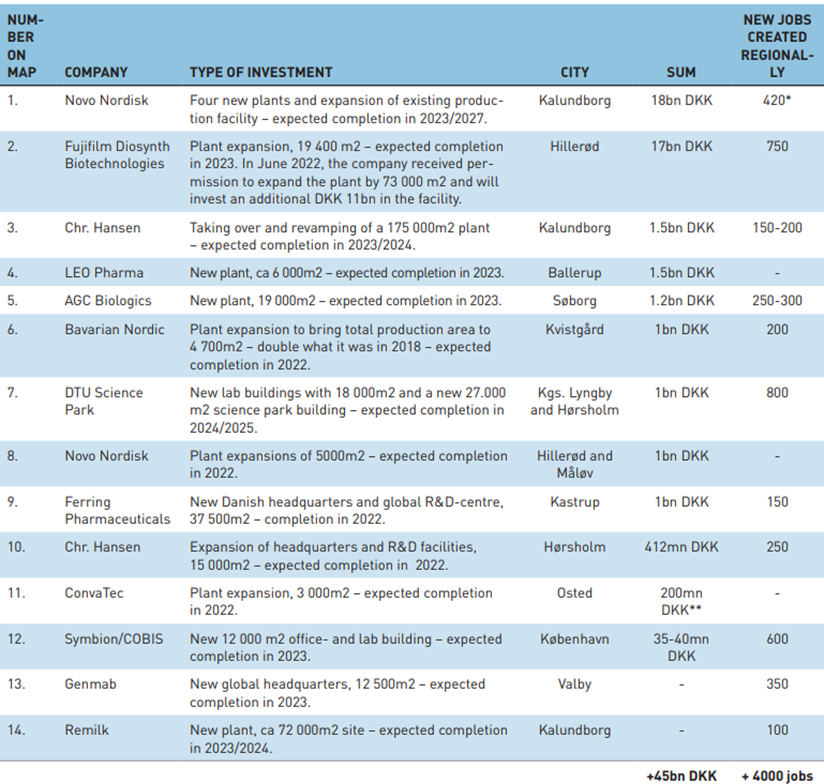

Once more, the case of the Danish side of Medicon Valley is emblematic: life sciences companies are expected to raise for over 45 billion DKK – corresponding to 6 billion euros – amplifying employment growth in the next years, with 4,000 new jobs predictable to be created. These funds are devoted to the expansion of production plants, research facilities and/or offices and domiciles in the region. Funding from both private foundations and government assistance also contributes to shared infrastructure developments in the region, including the construction of new motorways, research centres, and hospitals.

The pharmaceutical company Novo Nordisk and contract manufacturer Fujifilm Diosynth Biotechnologies are currently undertaking substantial investments in their facilities, marking the largest such endeavours. Many others are following this same path.

The Ambitious Investment Plans Recently Announced by Novo Nordisk

Commonly known for its extremely popular anti-obesity drug Wegovy, Novo Nordisk is the region’s largest company, relying on 23,000 employees across Denmark (and 55,000 in total around the world), generating a turnover of 140 billion DKK, equal to 18,8 billion euros. It is valued at around 375 billion US dollars on the stock market.

Novo Holdings, the investment fund overseeing Novo Nordisk, has constructed a business model focused on long-term returns rather than immediate shareholder rewards. This model is complemented by the Novo Nordisk Foundation, a non-profit and philanthropic entity that also has control over Novo Nordisk. Similar to the cases of Lego and Carlsberg, the existence of such a foundation has ensured that the company has not been sold to foreign buyers.

A key aspect of the mission of the foundation is to guarantee the sustained vibrancy of the Nordics as a scientific research hub, ensuring that the success of the company positively impacts the broader life science environment. Profits are channelled back into research projects through the foundation, including significant investments such as 300 million euros into a stem cell medicine research centre and 200 million euros into quantum computing for biology research.

Novo Nordisk is currently intensifying its investments in Denmark and in Europe: in November 2023, two major operations were presented.

Plans to increase existing manufacturing facilities in Kalundborg, eastern Denmark, are launched, with specific reference to the current and future product portfolio within serious chronic diseases. The 42 billion DKK investment (equivalent to 5.2 billion euros) is intended to expand capacity throughout the entire global value chain, spanning from the manufacturing of active pharmaceutical ingredients (API) to packaging, with the majority of the investment directed towards enhancing API capacity. The new API facility is planned to be a versatile, multi-product facility, equipped with the flexibility to accommodate both current and future processes. It will showcase state-of-the-art technology and provide a cutting-edge working environment.

In France, Novo Nordisk announced the investment of more than 16 billion DKK (2.1 billion euros) to expand the existing production site in Chartres. This initiative is expected to notably enhance the manufacturing site’s capacity by incorporating aseptic and finished production processes, along with expanding the current Quality Control Laboratory.

INCONCRETO, as an international consultancy, can provide expertise in capital project optimization in the pharmaceutical industry.

Connect with our people!

We combine technical expertise with large program execution practices, improving predictable outcomes and steering profitability on Capex/Opex project investments.

For further readings, you may consult these sources:

- Nordic Health Tech, by Nordic Innovation.

- Happy pills: How Sweden and Denmark became rare bright spots for Europe’s pharma industry, by Politico.

- Scandinavia: insight into opportunities for drug discovery, by Drug Discovery World.

- Pharmaceuticals increasingly important for Swedish economy, by BioStock.

- ESG in pharma: Meeting increasing requirements in the Nordic region, by Pharmaceutical Technology.

- Welcome to the heart of Nordic life science innovation, by Medicon Valley.

- Life Science in Medicon Valley, by Medicon Valley Alliance.

- Denmark puts its money where its life-sciences strategy is, by Nature.

Newsletter

© INCONCRETO. All rights reserved. Powered by AYM