INCONCRETO NEWS

Unveiling Green Capital Projects: their role in the Energy Sector’s for Climate Change Mitigation

Ensuring zero net emissions by 2050 is shared target among the most important economies of the world. Various strategies have been put into action by many countries, all with this shared objective.

In the wake of the Covid-19 pandemic, the formulation of recovery and resilience plans by the majority of governments all over the world, along with the subsequent allocation of financial resources are pivotal elements for attaining success, despite the beginning of the international crisis due to the Russia-Ukraine conflict in 2022. Moreover – and most important – they contribute to create the proactive environment for mobilising private finance to decarbonise infrastructures worldwide.

As a means for achieving this goal, the adoption of green capital projects can genuinely be a game-changer, given their significant influence on climate change. Capital projects, typically extensive and costly, encompass long-term construction endeavours. They are deemed “green” when they integrate Environmental, Social, and Governance (ESG) principles to target reductions in greenhouse gas (GHG) emissions and the responsible use of finite resources. In this regard, green capital projects establish a constructive cultural legacy by promoting sustainable practices, driving social transformation, and enhancing biodiversity.

Like any form of capital investment, green capital projects can be established and executed successfully if some favourable conditions are met. According to a set of recommendations finalised by PwC, ensuring that these investments support a sustainable transition requires to fulfil other key priorities, such as the finalisation of robust and realistic plans encouraging private-sector investments, a strong collaboration across sectors, a financial market focused on carbon and GHGs when lending and investing and the introduction of specific carbon taxes.

Conversely, the private sector can leverage the potential of ESG to generate value. As emphasized by McKinsey, companies that formulate and cultivate a strong ESG strategy experience top-line growth, cost reduction, increased strategic flexibility, and relief from regulatory pressures. Furthermore, allocating capital to more promising and sustainable opportunities not only improves investment returns but also fosters a positive impact on environmental and social stakeholders, as well as consumer preferences.

The case of green capital projects implemented in the energy sector, which we will examine here, is particularly emblematic.

Emerging energy sector trends: an amplified commitment to clean investments

Researchers from the International Energy Agency (IEA) have noted that the rebound from the Covid-19 pandemic and the response to the worldwide energy crisis have significantly bolstered global investments in clean energy.

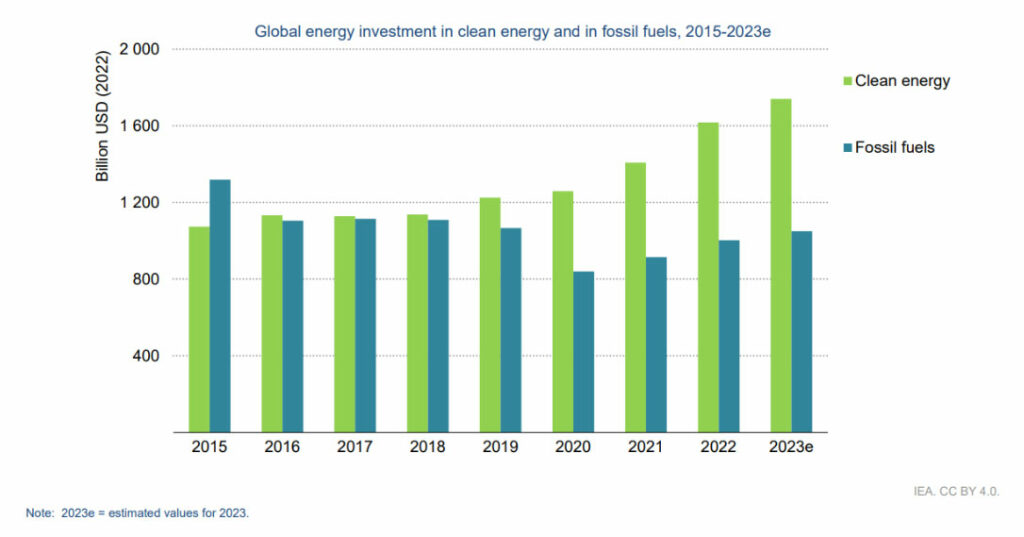

Over the last two years, the phase of substantial instability in fossil fuel markets, triggered by Russia’s invasion of Ukraine, has expedited the drive toward the adoption of various clean energy technologies, in parallel to a simultaneous and temporary rush to secure oil and gas resources. This acceleration follows a positive trend that began in 2016 when investments in clean energy surpassed those in fossil fuels.

Expected investments in the energy sector in 2023 are equal to approximately USD 2.8 trillion. Out of this total, over USD 1.7 trillion is set to be allocated to clean energy, encompassing renewable power, nuclear energy, grid infrastructure, energy storage, low-emission fuels, efficiency enhancements, and renewable energy for end-use applications.

The remaining portion, slightly exceeding USD 1 trillion, is projected to be directed toward fossil fuel supply and power generation. This portion includes approximately 15% for coal and the remainder for oil and gas. The IEA indicates that presently, for every USD 1 invested in fossil fuels, USD 1.7 is being allocated to clean energy, marking a significant shift from five years ago when the ratio was 1:1.

Solar is the star performer and more than USD 1 billion per day is expected to go into solar investments in 2023 (USD 380 billion for the year as a whole), edging this spending above that in upstream oil for the first time.

Notably, solar power has emerged as the main performer, with an estimated daily investment of over USD 1 billion expected in 2023 (totalling USD 380 billion for the entire year). This level of investment in solar projects is set to surpass that in upstream oil for the first time.

It is paramount to observe that the positive momentum behind clean energy investment is not uniformly distributed across countries or sectors.

The vast majority, over 90%, of the increase in clean energy investment since 2021 has been concentrated in advanced economies and China. What’s particularly striking is that the growth in clean energy investments in advanced economies and China during this period surpasses the total clean energy investments made in the rest of the world.

However, there are some positive developments in other regions. For instance, India continues to see dynamic growth in solar investment, while Brazil is experiencing a steady increase in deployment. Moreover, there’s a noticeable uptick in investor activity in parts of the Middle East, particularly in countries like Saudi Arabia, the United Arab Emirates, and Oman.

While solar projects have been consistently growing, the project pipeline for some other technologies has been less predictable. Wind power investments have fluctuated year-on-year in key markets due to changing policy circumstances. Nuclear investments are on the rise, but hydropower, which plays a crucial role in providing flexible and low-emission power, has been on a declining trend.

Finally, the IEA points out that a significant limiting factor for renewable investments in many developing economies is the inadequacy of grid infrastructure, and that investment flows in these regions are currently highly concentrated.

Towards the acceleration of a clean energy transition: assessing the cost of capital

At the core of realizing the objectives of net zero emissions is the necessity to direct significant capital flows into low-carbon energy sources.

The cost of capital plays a pivotal role in determining the overall expense associated with various energy technologies and reflects how financial markets perceive risks, such as the speed at which renewables might replace coal. It serves as a crucial conduit connecting the financial system and the real economy, influencing the investment choices made by both financial institutions and businesses. Therefore, to expedite the transition to low-carbon energy, it is imperative to witness a reduction in the cost of capital for clean energy.

The IEA warns that green resources typically entail substantial initial investment costs but offer lower operating and fuel expenses over time. Due to this, approximately 70% of clean energy investments expected until 2030 are projected to be undertaken by private developers, consumers, and financiers, who must correctly assess this cost of capital in the energy sector. It is calculated as the weighted average between the costs of debt and equity, where:

- The cost of debt is the interest rate or yield that the company, project or purchaser is able to secure from lenders.

- The cost of equity is the financial return expected by shareholders in exchange for providing capital and is also known as the expected return on equity.

A study conducted by the Oxford University and the Oxford Sustainable Finance Group and resumed by the World Economic Forum (2023) finds out that global renewable electric utilities companies with a higher proportion of solar and wind capacity currently benefit from a reduced cost of equity and debt compared to their fossil fuel-centric counterparts. This trend is particularly evident in Europe, where the effectiveness of climate-friendly policies in promoting cost-effective clean energy investments is emphasized: here, low-carbon utilities benefit from a lower cost of capital, while the opposite happens in China.

As per 2021, the cost of debt for renewable electric utilities stood at 6%, in contrast to 6.7% for fossil fuel utilities and equity costs were notably lower for renewable-focused utilities (15.2%) compared to fossil fuel-reliant ones (16.4%). In Europe, the gap between lower-carbon and higher-carbon utilities has continued to widen, reflecting how forward-looking equity investors are increasingly pricing in the transition risks associated with fossil fuels.

Similarly, in the field of energy production, the analysis reveals that coal mining exhibits the highest capital costs globally. The cost of debt in this sector reached 7.9% in 2021, while the cost of equity climbed to 18.2%. Interestingly, data shows that from 2016 onward, the cost of debt required for raising capital in renewable energy and technology has been steadily decreasing. Conversely, the cost of debt for coal mining has been on the rise during the same period.

The WEF emphasizes the rising risk associated with investments in carbon-intensive and capital-intensive oil and gas activities. Heightened by Russia’s actions in Ukraine, oil and gas prices have surged to their highest levels in a decade, strongly motivating economies to transition away from fossil fuels and redirect investments toward clean energy. Notably, Europe demonstrates the significant influence of environmental policies on asset pricing, a phenomenon less observed in North America and China, where climate action has been less uniform until now.

Seizing the momentum: driving innovative green initiatives in the energy sector

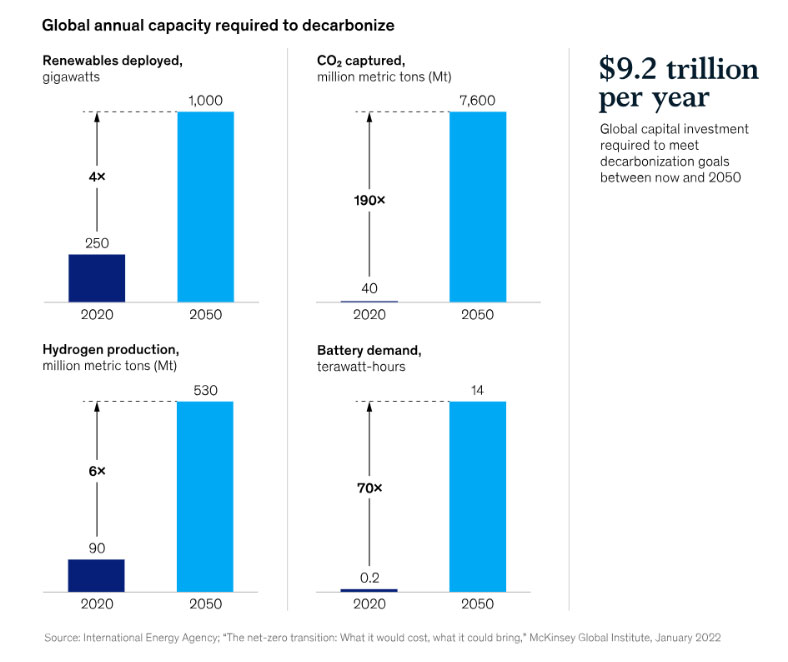

Building the path towards net zero emissions by 2050 demands that the global annual capacity is drastically increased.

A recent publication by McKinsey shows that there are four critical areas where investments must be tripled: renewables, hydrogen, battery storage, and CO₂ captured.

Analysts observe that the global renewable energy industry, particularly in solar and wind, has made substantial progress in increasing installed renewable capacity, while certain areas, such as carbon capture technologies, are at relatively emerging stages of development.

Concerning the case of hydrogen, McKinsey highlights the challenges of scaling new energy technologies. It is projected that by 2050, two primary fuels—electricity and hydrogen—will make up an estimated 50 % of the global energy mix. This growth is expected to be seen across different forms of hydrogen, including renewable “green” hydrogen, which is produced via the electrolysis of water. As regards cost parity, there is potential for enhancement in the levelized cost of hydrogen. However, achieving this result will impose the industry to make swift advancements in electrolyser systems, boost capital expenditures for hydrogen plants, and reduce electricity costs.

The future expansion of electric mobility – and therefore of battery demand – will necessitate dedicated green capital projects in the transportation sector. We will provide a more in-depth exploration of this subject in our upcoming publications.

INCONCRETO, as an international consultancy, can provide expertise in capital project optimization in the energy sector.

Connect with our team!

We combine technical expertise with large program execution practices, improving predictable outcomes and steering profitability on Capex/Opex project investments.

For further readings, you may consult these sources:

- Five ways that ESG creates value, by McKinsey & Co.

- Closing the green infrastructure gap, by PwC

- Towards orderly green transition – Investment Requirements and Managing Risks to Capital Flows, by OECD

- World Energy Investment 2023, by IEA

- The cost of capital in clean energy transitions, by IEA

- Energy Transition and the Changing Cost of Capital: 2023 Review, by the Oxford University and the Oxford Sustainable Finance Group

- How tracking changes in the cost of capital can accelerate investment in low-carbon energy, by the World Economic Forum

- Capital projects are critical for a green future, by McKinsey & Co.

Newsletter

© INCONCRETO. All rights reserved. Powered by AYM