INCONCRETO NEWS

The role of biotechnologies in the European economy – Part I

The use of biology as a technology, in various and multiple forms, has existed since the dawn of civilisation. Examples of this include the domestication of plants and animals, the discovery of fermentation and the exploitation of yeasts to bake.

Biotechnology is the combination of biology and engineering principles to create, develop and deploy new products, techniques, methods, and organisms, including microorganisms, to improve human health and society.

Nowadays, biotechnology is mostly associated with healthcare and pharma, accounting for more than 50% of applications, such as the discovery and creation of advanced medicines, therapies, diagnostics, and vaccines.

However, biotech products are also widely used in other sectors.

In agriculture and aquaculture, for example, biotechnology offers various advantages, such as the generation of genetically modified crops, the definition of biofuels, the improvement of plant growth and plant seed quality, and the advancement of animal health and breeding. In addition, biotech has enabled the use of enzymes for more efficient food processing and enhanced the breeding of plants to obtain desired characteristics.

Industrial processes and manufacturing also benefit from biotech, which contributes to the sustainable production of chemical products, materials, and fuels. For instance, enzymes can be used to reduce the multifaceted environmental impacts of industrial processes, including paper and pulp, chemical manufacturing, and textile.

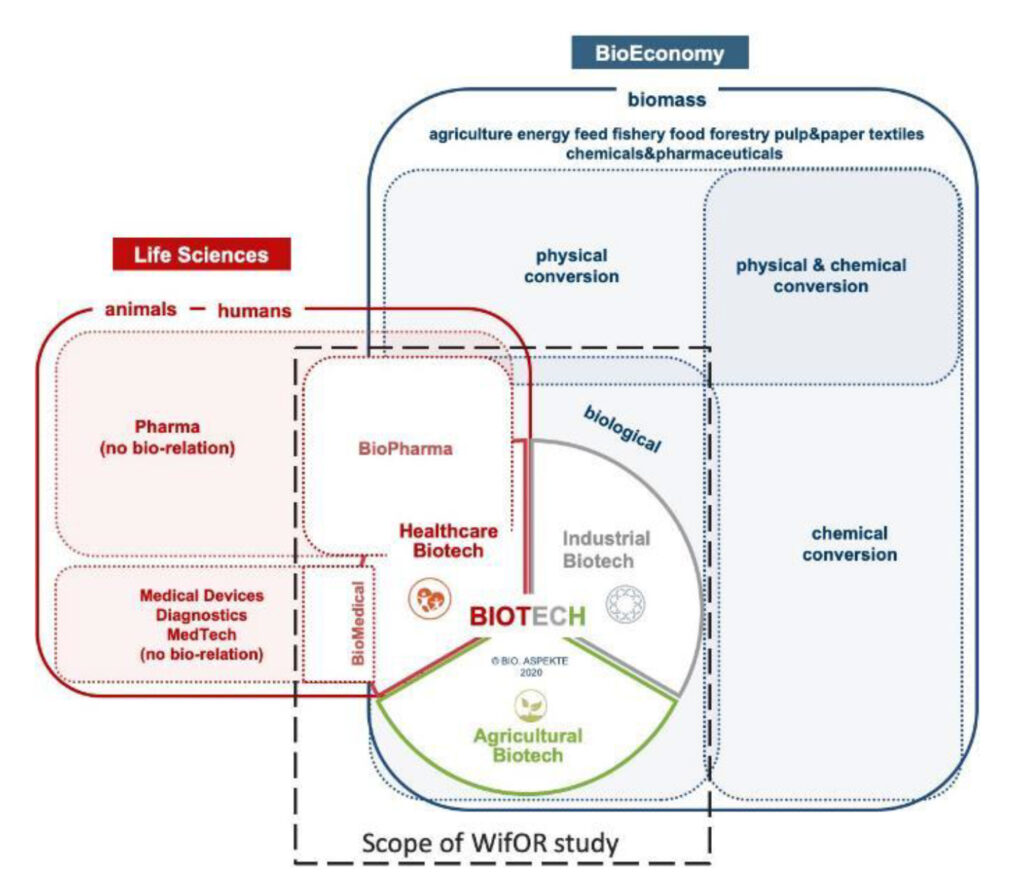

Context of sectors life sciences, biotechnology and bioeconomy

Describing the biotech market in Europe: a plethora of SMEs

The European Union has a complex and vibrant biotechnology landscape. It boasts hundreds of small and medium enterprises, including 2600 members of the most influential European Association of companies in biotechnologies, EuropaBio.

Over the decade preceding the COVID-19 pandemic, the European biotech sector displayed remarkable dynamism, enabling it to become one of the most significant macro areas for the industry worldwide.

In 2018, a study commissioned by EuropaBio revealed that biotech companies contributed to the GDP of the European Union to the tune of 34.5 billion euros, which represented an increase of 11.5 billion euros since 2008 and accounted for approximately 1.5% of the industrial sector’s gross value added (GVA). Taking into account the spillover effects, the global GVA rose up to 78.7 billion euros, comparable to the European advertising industry.

Furthermore, the biotechnology industry was one of the leading European industries in terms of innovation, having registered a growth rate of 4.1%, more than double that of the European ITC sector (2,00%) and the overall economy (1.9%).

This vitality was reflected in the labour market, which saw the creation of more than 220,000 jobs in each field of the biotech (especially in healthcare and manufacturing). Moreover the biotech sector is a major contributor to the European economy, supporting 710,500 jobs in the overall economy through indirect and induced effects, with an average labour productivity of over 150,000 euros of GVA per employee, outperforming other critical European industries, such as telecommunications and the financial sectors.

Additionally, the biotechnology sector registered an increasing trade surplus of more than €22 billion recently, becoming once again one of the most important contributors to the worldwide distribution of high-quality goods.

As we will see, this positive dynamic has been reaffirmed during the difficult times of the pandemic that began in 2020.

Despite the marked differences that are evident among European countries and represent their unique contributions to biotech as well as in all sectors, there is a consistent array of paths towards innovation and financing in the biotech industry.

Drivers for the continuous development of the biotech industry in Europe and obstacles to its growth

Based on the results delivered by McKinsey & Co. in the recent publication “Europe’s Bio Revolution: Biological innovations for complex problems”, experts consider Europe an important region for the establishment and continuous flourishment of biotech as a transformative industry.

The continent boasts a first-rate science base with high-quality scientific publishing and an active patent scene. In 2020, the latest year for which figures are available, the CWTS Leiden ranking rated Europe as the first, or most well-regarded, for publications covering health, agriculture, and industrial biotech, while the United States and China were positioned respectively at the second and the third places.

In European countries, we can globally observe an extremely effective level of R&D talent, which stands just a small portion behind the United States and well ahead of China. However, even if it is acknowledged that it conceives and delivers innovative products that could potentially increase the quality of life of European citizens, biotech industry in Europe is often considered to lack a sufficiently entrepreneurial mindset and to thrive sustainably, especially if compared to the United States. This means that the dynamism ensured by European SMEs that we mentioned above is not enough by itself to make this market leader of the future of biotech in the world.

Market fragmentation is one of the key challenges to effective coordination between policy makers at both the European and national levels and business leaders, in order to promote a cutting-edge risk-taking attitude for entrepreneurs in biotechnology.

The European Union’s policy priorities in the biotech sector range from its industrial strategy to the ambitious environmental goals set out in the European Green Deal, as well as the pharmaceutical strategy and an innovative approach to digital technologies.

This regulatory framework focuses on safety, and most European countries have banned the cultivation and sale of genetically engineered modified food products, which may have some industrial and agricultural applications. Moreover, health-care-related data is generally easily accessible through regional databases than in the United States, but biological and genomic data is essential for achieving the full potential of the “bio revolution”. Experts are urging Europe to focus on innovation with a strategic direction, as China, the UK, and the United States have done, while providing effective incentives such as reimbursement and tax breaks.

Securing funds for the industry: possibles avenues for European biotech

Figures show that investments in European biotech have considerably increased over the years.

In 2018, just before the beginning of the COVID-19 crisis, the average size of biotech M&A deals in Europe had grown to $165 million— a 20 percent per annum growth since 2012, though deal prices were still only 58 percent of the US level ($284 million) in 2018. Moreover, from 2012 to 2018, available venture capital (VC) tripled, reaching $2.3 billion due to the emergence of larger European VC funds.

Furthermore, during the pandemic, funding for biotech also registered increases: for instance, in the healthcare segment, which has seen the fastest growth, the average VC for funding for EU biotech companies grew by 42% between 2019 and 2021.

Despite these increases, the volume of funding in Europe still lies significantly below that in the US (four times lower), and its growth rate is slower. This means that overall innovation financing is still not adapted to the necessary targets for making Europe a strong leader in biotech, able to be sustainably compared to the U.S. and China.

The absolute number of companies that have received funding since 2015 in the United States (3,577) was more than double that of Europe (1,558) as of June 2021. Moreover, the average capital raised by each company was 1.5 times higher in the United States ($65 million) than in Europe ($40 million). For cross-functional clusters such as bioinformatics, biomaterials, cell-based clusters, gene-based clusters, genomic analysis, molecular diagnostics, and synthetic biology, the investment volume was more than four times higher in the United States ($52 million) than in Europe ($14 million) from 2018 to 2020, even if the volume of such investment had doubled in Europe from 2015 to 2017.

Some potential critical actions suggested by McKinsey & Co. to facilitate the propensity of investors towards the financing of biotech in Europe include:

- Revisiting valuation and accounting principles to reward innovation-driven investments

- Reconsidering incentives and regulations for VC funds and exploring structures of mutual funds to tap into institutional funding and scale up

- Seeking innovative co-development and intellectual-property arrangements allowing larger companies to conceive novel technologies with some of the world’s leading Bio Revolution players on industry-driven VC approaches (such as Novartis Venture Fund and Leaps by Bayer)

- Attracting investors from foreign countries

INCONCRETO, as an international consultancy, can provide expertise in capital project optimization and oversee critical paths for biotech project execution.

Connect with our team!

We combine technical expertise with large program execution practices, improving predictable outcomes and steering profitability on Capex/Opex project investments.

For further reading, you may consult these sources:

What is biotechnology?, by TechTarget.com

Measuring the economic footprint of the Technology Industry in Europe, by EuropaBio

Cofund on Biotechnologies. Innovation for Europe – life science meets market application, by Cobiotech.eu

Biotech in Europe: A strong foundation for growth and innovation, by McKinsey & Co.

The European Commission’s Toolbox for Biotech SMEs and Start-Ups (Event Recording), by EuropaBio (on Youtube)

Europe’s Bio Revolution: Biological innovations for complex problems, by McKinsey & Co

Newsletter

© INCONCRETO. All rights reserved. Powered by AYM