INCONCRETO NEWS

The lithium affair: designing the future through sustainable investments

It is white coloured, almost silver. It is particularly rare all over the world but it becomes increasingly requested. This is why lithium is known as the white gold. It has the lowest density of all metals. It reacts intensely when put in contact with water, forming hydrated oxide and highly flammable hydrogen. Despite being named after the Ancient Greek word for “stone”, which common sense tends to associate to something heavy, it is the lightest of the existing metals.

Petalite and lepidolite, mineral from which lithium is extracted

These are the general characteristics of lithium, which does not occur as a metal alone in nature: it is found combined in small amounts in nearly all igneous rocks and in the waters of many mineral springs. The most important minerals containing lithium are spodumene, petalite, lepidolite, and amblygonite.

The first lithium mineral petalite was discovered on the Swedish island of Utö in the 1790s: it had been observed that the lithium gives an intense crimson flame when thrown onto a fire. In 1817, Johan August Arfvedson from Sweden analysed lithium and deduced that he was discovering a previously unknown metal. It was only in the mid of the 19th century that it was finally possible to obtain it in bulk by the electrolysis of molten lithium chloride.

Why is lithium important today?

Since its discovery, lithium has been progressively employed for different uses, in various sectors.

Currently, it is exploited in the ceramic and glass industry, in metallurgy, in electronics and military applications, in optics and organic chemistry, up to also reaching the medical-therapeutic field.

In fact, lithium as a metal is combined into alloys with other materials such as aluminium and magnesium, allowing to improve their strength and making them lighter: magnesium-lithium alloy is used for armour plating, while aluminium-lithium alloys are used in aircraft, bicycle frames and high-speed trains.

Other chemical compounds for lithium include lithium oxide, which is used in special glasses and glass ceramics, lithium chloride, one of the most hygroscopic materials known, which is used in air conditioning and industrial drying systems (as it is the case for lithium bromide). Moreover, lithium stearate is used as an all-purpose and high-temperature lubricant and lithium carbonate is used in medicines and treatment for mental manic diseases, while lithium hydride is used as a means of storing hydrogen for use as a fuel.

These ones are very specific applications of lithium, which is here employed in relatively small quantities.

However, an unprecedented and quite recent lithium fever is taking place nowadays. This rush is due to the fact that lithium plays a key role in the conception and deployment of some non-rechargeable batteries for instruments like heart pacemakers or clocks, but especially in rechargeable batteries for mobile phones, laptops, digital cameras and – most importantly – for electric vehicles.

Lithium as a primary source for electric vehicle batteries

In an era as ours that sees the world mainstreaming the attempt to shift to an all-sectors carbon-neutral manufacturing production, automotive industry is the first in line being compelled to lead the way towards such change. All over the continents, policies are being implemented to fulfil ambitious targets for making the transport sector, which is the largest contributor to this greenhouse gas emissions, sustainable and eco-friendly.

Limiting transport emissions is key to meeting the European Union’s climate neutrality objectives. In 2021, clear objectives were settled to cut CO2 emissions from cars by 55% and vans by 50% by 2030, and to completely cut emissions from cars and vans by 2035. Such scenario requires that a significant increase in the uptake of electric vehicles is needed to achieve these goals.

With an analogous approach, the United States is implementing an eco-friendly policy to reduce carbon emissions to less than half of 2005 levels by 2030. The Government expects to increase the proportion of electric vehicles sales up to 50% by the end of this decade, especially by deploying an extensive plan for the installation of more than 500,000 charging stations. Canada followed a similar path, setting a mandatory target for all new light-duty cars and passenger trucks to be zero-emission by 2035, accelerating the previous goal of 100% sales by 2040.

In China, which comes up to be the world’s largest carbon emitter, the transportation strategy is composed by more aggressive policies than in other countries. The ‘New Energy Automobile Industry Development Plan’, aims to raise the proportion of new energy vehicles – notably electric vehicles – to 20% of total new car sales by 2025, to 40% in 2030 and more than 50% in 2035.

As part of its decarbonization policy, Japan is supporting the expansion of charging infrastructure to expand the supply of electric vehicles. However, Japan’s 100% eco-friendly car conversion includes hybrid cars equipped with both an internal combustion engine and a motor.

Such aspirations developed in parallel and equally shared by these advanced economies, are all based on a common means: the large-scale diffusion of electric vehicles (EV) on the market and their use by the consumers. Yet, this cannot happen unless the lithium industry becomes efficient enough to underpin the development of EV, which may not result as rapid as projected.

The lithium deficit roadmap

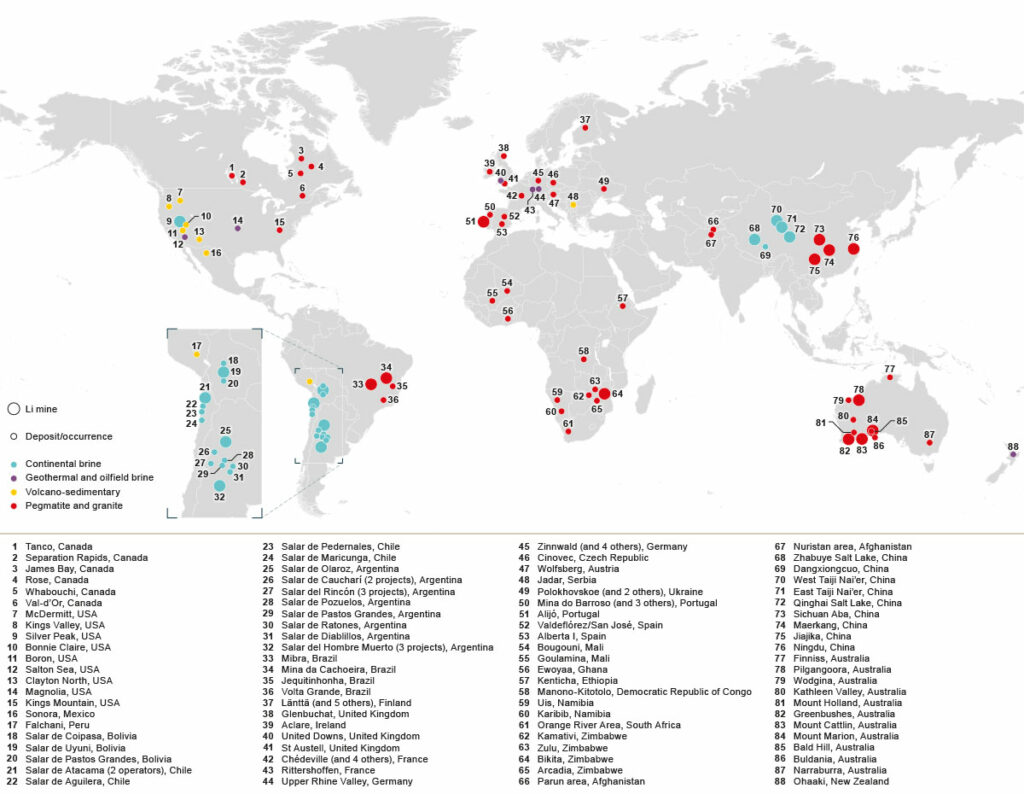

Lithium can mainly be extracted from two key sources: brines and minerals. Currently lithium-bearing minerals, such as spodumene and petalite, are primarily obtained from pegmatites, but it is believed that future sources of lithium will include hectorite and jadarite that are found in some sedimentary basins. Concerning extraction of lithium from brines, it predominantly occurs from continental brine deposits.

Unfortunately, reserves of lithium are not widespread all over the world.

Source: Shaw, R.A. (2021) Global lithium (Li) mines, deposits and occurrences (November 2021). British Geological Survey

The main lithium mine reserves are located in the so-called “Lithium Triangle”, which covers a large area at the intersection of Argentina, Chile and Bolivia: here is contained 54% of the world’s lithium resources, amounting around 11 million metric tons. In this region, lithium comes mainly from brine deposits, meaning that it is discovered in salty, underground water that is evaporated by the sun after being pumped into large artificial lakes.

On the contrary, outside South America, lithium is extracted from hard rocks. This is the case for Australia, which holds 4,5 million MT of reserves, and China (1,5 million MT). Smaller amounts but still considerable and exploitable are located in the United States (750,000 MT), Canada (530,000 MT), Zimbabwe (220,000 MT), Brazil (95,000 MT).

In Europe, Portugal is the most important country having significant reserves of lithium, amounting about 60,000 MT.

Existing (and virtual) players

Today, in the industry of lithium, there are four historically existing players: SQM, Albermarle, Ganfeng and Tianqi. Numbers fifth and sixth, Livent and Allkem, follow but with different levels of production: combined this is less than half of the chemical production of the smallest “Big 4” players.

However, experts observe that since the demand for Lithium Carbonate Equivalent (LCE) – which is the first commonly traded Lithium intermediate in the value chain – is expected to increase at more than 200,000 MT per year, it will be necessary to evolve the range of players acting on the market. Though, doubling or even multiplying the number of lithium suppliers is not something that seems possible to effectively implement before the second half of the current decade. In fact, the lack of durable investments in brine, hard rock and sedimentary projects in the last years caused especially by larger battery companies have provoked the current lithium supply shortage, which will be lasting until 2030.

Major delays have been cumulated in different countries – especially in the “Lithium Triangle” –, where governments have been failing in the attempt to ensure to put in place efficient and effective production systems. In Bolivia, the Government nationalised its lithium industry years ago and has yet to produce important amounts of the metal, while Argentina has just started to take off its output. In 2016, Chile expanded by 80% its existing operations and has been producing 140,000 MT annually since then. Now regretting past privatizations, the Government is planning to create a state lithium company, but the present instability following the rejection of the constitutional referendum in September 2022 will potentially cause other delays.

Moreover, the period for construction of a new mine must include the time to devote to negotiations with local populations and environmentalists and to the definition of sustainable ways of production.

In the meantime, new emerging “virtual” players are announcing that they are going to join the lithium industry and to exploit new mines. They are proposing “virtual lithium supply agreements”, signed by companies delivering batteries for electric vehicles. It is commonly thought that this plethora of new players, which are projecting their production for 2026 and beyond, will progressively gain importance in order to try to respond to the demand of batteries coming from the automobile industry.

Ambitious EVs plans by automakers

The lack of sustainable investments in new production of lithium, and the subsequent risk not to completely fulfil the global demand before 2030, might undermine the realisation of the ambitious plans that automakers have built in terms of electric vehicles’ sales.

By 2025, a percentage of 84% of all lithium produced is expected to be used in batteries for electric vehicles, energy storage systems (ESS), and portable electronics. Therefore, this share should cover the production of 10 million electric vehicles forecasted for that year.

Furthermore, even if all lithium projects expected to be applied by 2030 are executed, data today point out that there is still a gap of 220,000 MT to the 2 million MT requested by this date – which will be needed to fulfil a demand of more than 20 million EVs, accounting for about 32% of the global all-kind vehicles sales.

These statistics are coherent with ambitions established globally. As an example, the European Union’s goals indicate that by 2030, 35% of new vehicles sold across Europe will consist of only eco-friendly vehicles such as electric vehicles, and sales of new vehicles with internal combustion engines will be completely banned starting from 2035.

European automakers are adapting their lines of production subsequently. Some cases are telling:

- Mercedes-Benz revised its electrification strategy from ‘Electric First’ to ‘Electric Only’: all new models to be unveiled from 2025 will present an electric vehicle-only architecture.

- BMW is accelerating the electrification of electric vehicles and, from 2025 onwards, will increase its delivery share of all-electric vehicles to 50%.

- Volkswagen is planning to build 1.3 million EVs in 2023, as it works towards making half its global output all-electric by 2030.

- Volvo is also spurring electrification, planning to manufacture only completely zero-emission vehicles in 2030: the group is willing to become the first global brand with 100% electrification.

- Stellantis aims to become the market leader in low-emission vehicles (LEVs), with the goal that by 2030 LEVs will account for more than 70% of its sales in Europe and more than 40% in the United States.

The growing demand for lithium, to be used in these transport applications, made lithium prices explode up to more than 750% in 2021.

Processing lithium: the main challenges

Based on the evident change which is programmed in the transport systems in the nearest future, the lithium industry faces some urgent challenges.

First, the competitive extraction costs which have secured supply in the past are not supposed to last anymore. The question of the affordability of primary lithium resources becomes predominant in the long run, as well as whether there are alternatives to continuing this energy transition.

Second, extracting lithium – whatever its source is – requires a complex processing and specific conditions.

As regards lithium extraction from hard rock ores, this is a relatively complex and energy-intensive process, involving multiple stages to release the lithium from the ore – this includes high temperatures and considerable energy consumption.

Extracting lithium from salt-flat brines is relatively straightforward but is a time-intensive process as it takes several months of progressive evaporation to reach a sufficiently high lithium concentration in the brine for economic recovery. In this respect, other important resources – and their availability and use – come into play, also raising crucial environmental questions: for instance, Chilean experts observe that up to 2,800 cubic meters of water are needed to produce one ton of lithium, versus 70 cubic meters for a ton of copper.

In both cases, processing the opening of new mining sites might require up to 10 years before entry to force.

Shifting all through the supply chain which leads from the extraction of lithium, its transformation and its assembling in batteries which are the main driver of electric vehicles, we observe that at present China takes the lion’s share.

China, already dominating the largest part of the entire battery supply chain, especially the refining of lithium is by far the leader in the battery race, holding nearly 80% of global Li-ion manufacturing capacity (U.S. follows from afar, with around 6% or 44 GWh of global manufacturing capacity, while European countries collectively make up for 68 GWh or around 10%).

Even if the final product will have a positive environmental impact, the Chinese manufacturing of batteries is based on coal as the primary energy source, which leads to emit roughly twice the amount of greenhouse gases as natural gas.

Such geographical segmentation, combined with the relative scarcity of lithium and the exploding demand, as well as with non-eco-friendly processing practices, implies higher costs of production. In the end it becomes more difficult to optimise, both from an economic and an environmental perspective, each step of the lithium chain and to ensure a full and sustainable vertical integration.

Finding a path throughout sustainability

Dealing with a scenario where lithium demand continues to rise – and therefore prices are expected to increase – leads to exploring other possible solutions in view of optimising the production and preserving the environment.

In this framework, it becomes imperative to develop a positive dynamic in favour of these potentially positive outcomes. The creation of a more competitive market, and the renewed spirit of research that comes along, can really make the difference.

The incentives to recycle depreciated lithium will be enhanced as lithium prices rise. Also, the rush of lithium is going to promote new investments and discoveries and even remote and costly resources from the ocean could become economically attractive, and then increase available stocks, with more governments and industrial players focusing on this priority.

Sustainable energy management techniques in manufacturing lithium can be applied to use energy more efficiently, starting from a more effective overall heat recovery.

Finally, a specific focus is needed on batteries themselves. Attention is therefore going to be increasingly concentrated on the recycling of lithium-ion batteries and the secondary raw materials or recycled waste materials that can be gained from them.

The European largest opportunity in the lithium industry: the case of Portugal

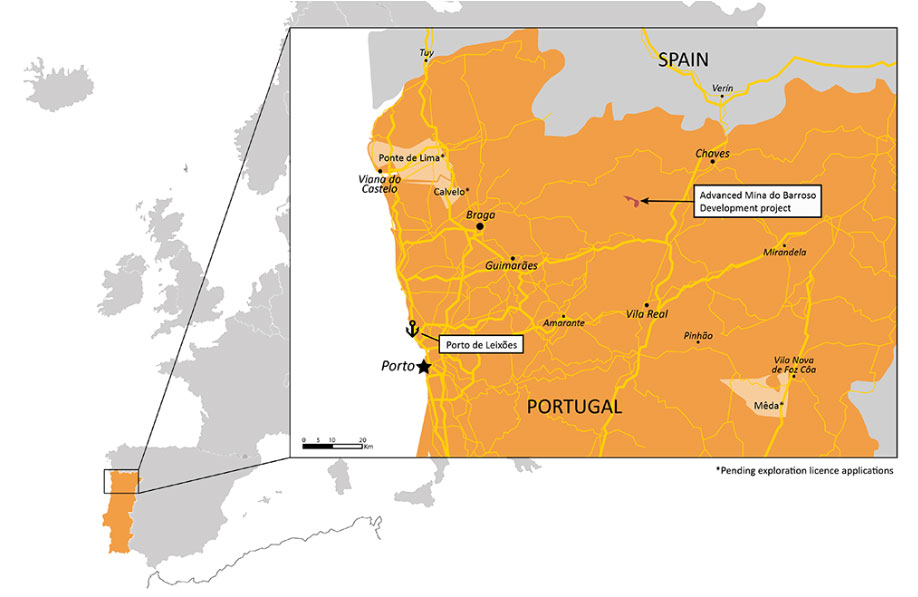

Even if its production is limited in comparison to other regions of the world, Portugal is by far Europe’s biggest lithium producer. The main reserves, which come from pegmatite and granite, are located in northern Portugal, approximately 145km northeast of the City of Porto and the industrial port of Leixões.

Source: Savannah Resources

In the past and until now, the metal has been sold almost exclusively to the ceramics industry. Yet, Portugal is now preparing to level up and to produce the higher-grade lithium for use in electric cars and electronic devices.

The country becomes key not just for the extraction of lithium but also for its manufacturing in view of its use for electric batteries. To this end, Swedish battery system supplier Northvolt and Portuguese oil group Galp Energia have announced the creation of a joint venture, named “Aurora”, to build a battery-grade lithium conversion plant in Portugal. Starting from 2026, this could reach an annual production capacity of 35,000 MT of lithium hydroxide, i.e. the quantity needed to produce 50 GWh of batteries per year, representing the equipment of around 700,000 electric vehicles.

In terms of supply, Northvolt and Galp are betting on the exploitation of what could soon be the largest lithium mine in Europe. Being authorised by the Portuguese Environmental Authority, the British mining company Savannah Resources could, in fact, launch the exploitation of a lithium deposit in the North of Portugal.

“Aurora” can develop opportunities across the entire value chain and want to use green energy to fuel the conversion process. “The development of a European battery manufacturing industry offers huge economic and societal opportunities for the region. Extending the new European value chain upstream to include raw materials is of crucial importance” highlights Paolo Cerruti, co-founder and COO of Northvolt.

Interview with François Abiven, CEO and Senior Partner at INCONCRETO

François, you are a high-level professional engineer with more than 30 years’ experience in strategic business development and in delivering complex projects.

We are delighted to have the opportunity to be in your company while discovering the fascinating world of lithium, which you know so well. First, why can we call lithium the petroleum of the 21st century?

Lithium is a chemical element. It is a soft, silvery-white alkali metal. Although it has been known for almost two centuries, lithium is suddenly making the news: it is the primary ingredient of the lithium-ion batteries set to power the next generation of electric vehicles and, as such, could become as precious as gold in this century. Lithium is also used in batteries for mobile phones, laptops, digital cameras, heart pacemakers and numerous toys. In practice two components of the battery are made with lithium compounds: the cathode and the electrolyte. There are, however, several different chemistries of Lithium batteries on the market and are all suited to various applications.

In Europe there is one non negligible source of lithium. What is the strength of Portugal in the lithium industry compared to the bigger producers all over the world?

Lithium mining projects of varying sizes have been popping up in locations across Europe over recent years, from Cornwall in the UK to the Upper Rhine Valley in Germany and the west coast of Finland. Portugal has the biggest lithium reserves in Europe, coming in at 60,000 million tons. So, Portugal is central to Europe’s bid to secure more of the battery value chain and cut reliance on imports and there are more supply chain challenges ahead as automakers attempt to ramp up electric vehicles production and lithium miners expand output.

In the lithium processing, which techniques can be implemented to use energy more efficiently?

The production of lithium compounds can be done from two raw materials: from mineral resources such as spodumene which is energy and chemical intensive or from underground brine, more energy efficient but with other issues such as the water consumption and waste. But these challenges are not exclusive to the lithium processing: all specialty chemicals products manufacturers in the world would have to implement the best available technology, find the most efficient energy solution while preserving the environment. Finding the right balance between these three objectives is a sweet spot to be found on a case by case and INCONCRETO has the right expertise and experience to support this quest. There are solutions but my experience is that often projects front-end loading (technology selection & planning) is not sufficiently developed: this probably the most important of the project phases as it is where project teams pick the final process options and prepare strategies for how to deliver.

How can sustainability be ensured in lithium processing?

Currently, almost all lithium mining and transformation occurs in Australia, Latin America, and China. An announced pipeline of projects will likely introduce new players and geographies to the lithium-mining and processing map, including Europe USA and Canada: this new stream of projects will fuel innovation and raise the sustainability bar. Each production industry in the world is now concerned by sustainability: INCONCRETO motto could be Capital planning in a changing world. We believe sustainability should be a value and we use our extensive industry network to explore with our clients, solutions around: 1) Industrialization & standardization 2) Digitalization of products and processes 3) Supply chains innovation 4) sustainability in project delivery which a project management and project delivery methodology balancing economic results, social aspects, environment, and safety compliance. From a technical point of view Lithium compounds dedicated to electric vehicles demand the highest quality (or grade); energy, waste treatment (including recycling), process efficiency (especially the ovens) are the key elements to consider.

Transforming Resistance into Participation. This is the approach that INCONCRETO can ensure to make the project led by Aurora in Portugal a truthful success.

What are your proposals, capitalising on the expertise of INCONCRETO’s manifold Team?

INCONCRETO is mainly contracted as Program Management Officer (PMO); the traditional relationship framework for governing interactions between two or more organizations assumes that the different parties act in their own self-interest. To engage all the project parties and convince the external stakeholders we believe in adaptive partnerships: moving away from traditional customer-supplier relationships toward adaptive strategic partnerships and shifts the institutional framework on three dimensions: (1) governance, (2) information and (3) collaboration mechanisms. These dimensions are paving the way new level of collaboration, communication and public information.

INCONCRETO services

The Construction is the biggest industry in the world, and yet, even outside of crises, it is not performing well: inefficiencies, overruns, delays and quality issues are common for that industry which represents 13 percent of global GDP.

INCONCRETO is a unique team of Senior Partners which improves predictable outcomes and steer profitability on Capex/Opex project investments. We quantify, assess, and share our expertise to drive your organization to the right decisions. We provide a unique platform combining digitization, ratings, and consultancy.

Our services offer is established on the latest consultancy market trends:

1) Digitization

2) Market focus

3) Global multi-sourcing

4) Digitalization

5) Agile (fail fast)

We remain open to new ideas, part of the global consultancy world and referenced as the capital projects expert.

For further reading, you may consult these sources:

- “Lithium”, by the Royal Chemistry Society

- “The Place With the Most Lithium Is Blowing the Electric-Car Revolution”, by the Wall Street Journal

- “Is It the Era of The Electric Car?”, by Hyundai Motor Group

- “New registrations of electric vehicles in Europe”, by European Environment Agency

- “How Effective is Lithium Recycling as a Remedy for Resource Scarcity?”, in Environmental and Resource Economics

- “Lithium: Virtual Reality” in Globallithium.net

- Four Companies Leading the Rise of Lithium & Battery Technology, by Global X

- “Mapped: EV Battery Manufacturing Capacity, by Region”, by Visual Capitalist

- “How much CO2 is emitted by manufacturing batteries?”, by Massachusetts Institute of Technology Climate Portal

- “Barroso Lithium Project, Portugal”, by Savannah Resources

- “Portugal awaits assessment of two lithium mines before launching auction”, by Reuters

- “Recycling of lithium-ion batteries in Germany and Europe” in Commodity Top News 67 (2022)

Newsletter

© INCONCRETO. All rights reserved. Powered by AYM