INCONCRETO NEWS

From Dependency to Autonomy? Europe’s 47 Critical Raw Materials Projects

In an effort to address this vulnerability, the European Commission presented, on 25th March 2025, an initial list of 47 key projects aimed at improving the extraction and processing of rare earths and critical raw materials within Europe.

The goals are to secure Europe’s supply chains and safeguard its strategic autonomy, and also to develop Europe’s capacity to source and refine strategic materials directly on the continent.

Lithium, cobalt, tungsten… These materials are now indispensable to modern industry, particularly for manufacturing electric vehicle batteries, solar panels, and radar systems. The European Union remains heavily reliant on imports—especially from China—to meet its needs.

On the following day, March 26th, the Spanish newspaper El País explicitly pointed to Europe’s excessive foreign dependency in these sectors, particularly on China. In an increasingly unstable geopolitical landscape, the EU is now determined to urgently address this vulnerability, the Spanish daily notes. Achieving greater autonomy is also essential for meeting Europe’s climate targets and ensuring the success of its energy transition, adds the French newspaper Les Échos.

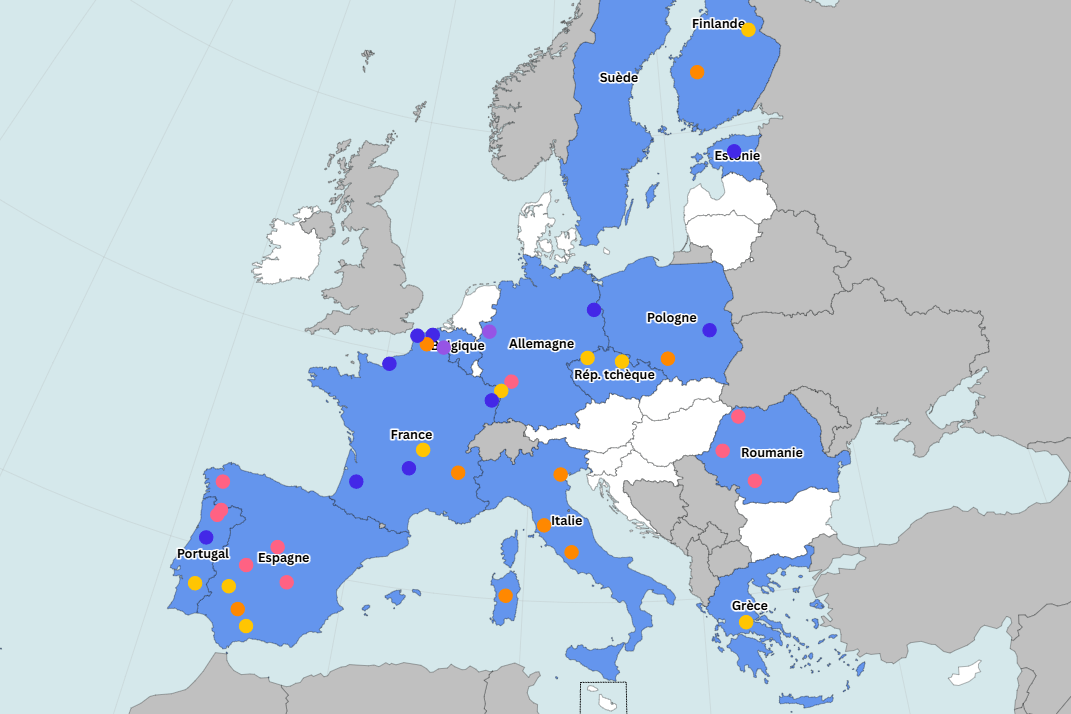

Where Are the EU’s 47 Strategic Projects Located?

The exact locations of the sites have not been disclosed by the European Commission. They are therefore regional in nature.

One year after adopting its Critical Raw Materials Act, the European Union is moving to the next stage by unveiling 47 strategic projects across 13 Member States: Belgium, France, Italy, Germany, Spain, Estonia, Czechia, Greece, Sweden, Finland, Portugal, Poland, and Romania. Up to nine sites may be located in France.

In detail, the list includes 25 projects involving extraction activities, 24 in processing (some combining both), 10 focused on recycling, and 2 on the substitution of raw materials. Of these, 22 projects concern lithium, 11 involve graphite, 10 cobalt, and 7 focus on manganese.

14 out of 17 critical raw materials covered

Why it matters: Critical raw materials are not only needed for EVs and solar panels—they’re also essential for telecoms, defense systems, and artificial intelligence.

The announced projects address 14 of the 17 strategic raw materials listed under the EU’s legislation. For each of these resources, the European Commission has produced a detailed information sheet outlining potential applications, as well as current sources of supply. Clicking on each material in the list above will take you to its dedicated information sheet provided by the European Commission, detailing its uses and supply sources:

Aluminium, Boron, Cobalt, Copper, Gallium, Germanium, Graphite, Lithium, Magnesium, Manganese, Nickel, Platinum group metals, Tungsten, Rare earth elements.

Funding to meet its objectives

The selected projects will receive a total of €22.5 billion, alongside the European Commission’s official label. To kick off swiftly, they will also benefit from expedited procedures. Permits will be issued within 27 months for extraction projects and 15 months for others. Currently, authorisation processes can take anywhere from five to ten years, the European Commission states.

A second wave is expected to include projects in non-EU countries such as Ukraine or Greenland – areas recently eyed by Donald Trump for similar reasons.

According to the European Commission, all of these projects are designed to achieve ambitious goals: ensuring that European extraction, processing, and recycling of strategic raw materials each account for 10%, 40%, and 25% of the EU’s demand by 2030.

The 47 selected projects in detail

| Project Name | Project Type | Promoter | Country | Strategic Raw Material(s) | |

| 1 | GePETO | Processing | Umicore | Belgium | Germanium |

| 2 | ReGAIN | Substitution | Umicore | Belgium | Germanium |

| 3 | Chvaletice Manganese Project | Extraction & Processing | Euro Manganese Inc | Czech Republic | Manganese |

| 4 | Cínovec Lithium Project | Extraction & Processing | Geomet s.r.o. | Czech Republic | Lithium |

| 5 | CO2 Graphite | Processing | UP Catalyst | Estonia | Graphite |

| 6 | Hycamite TCD Technologies Ltd | Processing | Hycamite TCD Technologies Ltd. | Finland | Graphite |

| 7 | Jervois Finland Cobalt Refinery Expansion Project | Processing | Jervois Finland Oy | Finland | Cobalt |

| 8 | KELIBER Lithium Project | Extraction & Processing | KELIBER TECHNOLOGY OY | Finland | Lithium |

| 9 | Kolmisoppi | Extraction | Terrafame Ltd | Finland | Nickel, cobalt |

| 10 | Project Fortum Hydromet | Recycling | Fortum Battery Recycling Oy | Finland | Lithium, copper, nickel, cobalt |

| 11 | Sakatti Project | Extraction & Processing | Anglo American Services (UK) Ltd. | Finland | Cobalt, platinum group metals, copper, nickel |

| 12 | Ageli | Extraction & Processing | Eramet | France | Lithium |

| 13 | BAM4EVER (Phase I&II) | Processing | Tokai COBEX Savoie | France | Graphite |

| 14 | CAREMAG | Processing | CAREMAG SAS | France | Rare earth magnets, boron (metallurgical grade) |

| 15 | Emili | Extraction & Processing | IMERYS Ceramics France | France | Lithium |

| 16 | GALLICAM | Processing | SIBANYE-STILLWATER SANDOUVILLE REFINERY | France | Nickel, cobalt, lithium, graphite, manganese, copper |

| 17 | Hydrometallurgy | Recycling | ORANO Batteries | France | Lithium, cobalt, nickel, manganese, graphite |

| 18 | MagFactory | Recycling | MagREEsource | France | Rare earth magnets |

| 19 | Viridian Lithium | Processing | Viridian Lithium | France | Lithium |

| 20 | European Initiative for Strategic and Sustainable Graphite Production | Processing | NGC Battery Materials GmbH | France (main site), Namibia, Germany | Graphite |

| 21 | Lithium Hydroxide Converter Guben | Processing | Rock Tech Guben GmbH | Germany | Lithium |

| 22 | ProHiPerSi | Substitution | PCC Thorion GmbH | Germany | Graphite |

| 23 | Zero Carbon Lithium | Extraction | Vulcan Energy Ressourcen GmbH | Germany | Lithium |

| 24 | Metlen BAUX-EU, GALLANT, LEADER | Extraction & Processing | Metlen Energy and Metals and European Bauxites | Greece | Bauxite, alumina, aluminium, gallium |

| 25 | Alpha Project | Recycling | Solvay Chimica Italia Spa | Italy | Platinum group metals |

| 26 | LIFE-22-ENV-IT-INSPIREE | Recycling | Itelyum Regeneration SpA | Italy | Rare earth magnets |

| 27 | Portovesme CRM Hub | Recycling | Portovesme srl | Italy | Lithium |

| 28 | RECOVER-IT | Recycling | Circular Materials s.r.l. | Italy | Copper, nickel, platinum group metals |

| 29 | POLVOLT | Recycling | Elemental Strategic Metals Sp. z o.o. | Poland | Nickel, copper, cobalt, lithium, platinum group metals, manganese |

| 30 | Pulawy Rare Earths Separation Plant | Processing | Mkango Resources Ltd. | Poland | Rare earth magnets |

| 31 | Barroso Lithium Project | Extraction | Savannah Lithium Unipessoal, Lda | Portugal | Lithium |

| 32 | Lift One | Processing | Lithtium Energy S.A. | Portugal | Lithium |

| 33 | Neves Corvo – 3rd Silo, Lombador, Semblana | Integrated: Extraction & Processing | SOMINCOR | Portugal | Copper |

| 34 | Romano Mine | Extraction | Lusorecursos Portugal Lithium S.A. | Portugal | Lithium |

| 35 | Rovina | Extraction | Euro Sun Mining Inc. | Romania | Copper |

| 36 | SALROM Baia de Fier | Extraction | Societatea Națională a Sării S.A. | Romania | Graphite |

| 37 | Verde Magnesium | Extraction | Verde Magnesium SRL | Romania | Metallic magnesium |

| 38 | Aguablanca Project | Extraction | RIO NARCEA RECURSOS S.A. | Spain | Cobalt, platinum group metals, copper, nickel |

| 39 | CirCular | Recycling | Atlantic Copper SLU | Spain | Copper, platinum group metals |

| 40 | LAS NAVAS | Extraction | LITHIUM IBERIA, S.L. | Spain | Lithium |

| 41 | MINA DOADE PROJECT | Extraction | RECURSOS MINERALES DE GALICIA, S.A. | Spain | Lithium |

| 42 | Mining Project EL MOTO | Extraction | ABENÓJAR TUNGSTEN S.L. | Spain | Tungsten |

| 43 | P6 Metals | Extraction & Processing | Iberian Resources Spain | Spain | Tungsten |

| 44 | Polymetallic Primary Sulphite Project (PMR) | Extraction & Processing | Cobre las Cruces S.A.U. | Spain | Copper |

| 45 | NorthCYCLE | Recycling | Northvolt Revolt AB | Sweden | Manganese, lithium, graphite, nickel, cobalt |

| 46 | Talga Natural Graphite ONE | Extraction | Talga AB | Sweden | Graphite |

| 47 | ReeMAP Project: Malmberget, Lulea Industrial Park, Per Geijer | Extraction & Processing | LKAB (Luossavaara-Kirunavaara AB) | Sweden | Rare earth magnets |

A Strategic Turning Point, or the Beginning of New Dependencies?

While the unveiling of these 47 projects signals a turning point in Europe’s industrial and geopolitical posture, it also highlights the complexity of building real autonomy. The ambition is clear: to diversify sources of supply and reduce strategic vulnerabilities, particularly vis-à-vis China, which currently dominates the refining of rare earths and other critical materials. As outlined in the EU’s Critical Raw Materials Act, the EU’s goal is also to ensure that no more than 65% of its annual consumption of any strategic raw material is dependent on a single third country.

However, establishing extraction and refining operations in Europe is not without challenges. Several of the selected projects face resistance at the local level due to environmental concerns. For instance, the Barroso Lithium Project in Portugal has already triggered opposition from environmentalists and local communities. These tensions underscore the friction between industrial sovereignty and ecological preservation—two goals that the European Green Deal seeks to reconcile.

Permitting Bottlenecks and Fast-Track Pathways

The fast-tracked permitting system introduced by the Commission—27 months for extraction projects and 15 months for processing—represents a major procedural shift. As reported by France’s national broadcaster TF1, current approval timelines often stretch beyond five years. But such acceleration raises another question: can Europe maintain rigorous environmental and social standards while racing to meet its supply targets?

“The long neglect of raw materials in industrial policy is catching up with us,” admitted Stéphane Séjourné, Vice-President of the European Commission. His statement in Les Echos captures the urgency now driving Brussels: “There is no decarbonisation without raw materials. No defence industry without rare earths.” The dependency on China is particularly acute in refined materials like rare earth magnets, which are essential for both wind turbines and missile systems.

Industrial Opportunity, but with New Risks

Several of the strategic projects—especially those focusing on recycling or substitution—aim to reduce pressure on primary extraction. This is a notable development. Recycling initiatives such as MagFactory (France) or NorthCYCLE (Sweden) offer a pathway toward more circular use of resources and less geopolitical exposure. Substitution technologies, still in early stages, could also weaken the monopoly of certain suppliers.

Yet, the EU’s race for critical materials could inadvertently spark a new wave of extractive dependencies—this time in partner countries. The European Commission is already looking to non-EU territories like Ukraine and Greenland for the second wave of projects. As the French newspaper La Croix indicates, these partnerships must not repeat patterns of unequal exploitation that have characterized previous resource rushes.

A European Industrial Renaissance?

There is undeniable industrial potential. By developing its own capacity to extract, process, and recycle critical raw materials, the EU could revive parts of its heavy industry and anchor new clean tech value chains on European soil. Projects like Zero Carbon Lithium in Germany or Emili in France aim to combine sustainability with competitiveness. If successful, they could set a global benchmark.

Still, the path ahead is complex. Public opinion, market volatility, geopolitical uncertainties, and raw material prices will influence the viability of these ventures. For now, the 47 projects are a first step—not a guarantee. If successful, these projects could mark the beginning of a new phase in Europe’s industrial policy—one that balances autonomy with sustainability, and competition with cooperation.

👉 Interactive Map of Strategic Projects

You can explore the interactive map provided by the European Commission to view each project’s location and details. This map allows you to filter projects by country, project type, and specific raw materials, offering a comprehensive overview of the EU’s efforts to secure critical raw materials.

About INCONCRETO

As Europe accelerates efforts to secure strategic autonomy in critical raw materials, INCONCRETO stands as a trusted partner for capital project optimization in the mining and refining sectors. With a focus on improving predictability and maximizing returns, INCONCRETO brings international consultancy expertise to support strategic projects like those unveiled by the European Commission.

Our services include:

– Business Planning and Project Execution to ensure resource-efficient, scalable development

– Due Diligence, and Auditing to navigate investments across extraction, processing, and recycling

– Technology and Supply Chain Optimization tailored to the evolving demands of the global critical materials landscape

INCONCRETO is committed to helping industry leaders align performance with sustainability in the new era of European industrial policy.

For further reading, you may consult these sources

Latest News

Semiconductors Today: Global Industry Dynamics and Strategic Value Chains

Mining Today, Powering Tomorrow: The Global Race for Transition Minerals

Newsletter

© INCONCRETO. All rights reserved. Powered by AYM