INCONCRETO NEWS

Semiconductors Today: Global Industry Dynamics and Strategic Value Chains

The semiconductor industry stands at a pivotal juncture, having become a decisive arena for technological leadership, economic security, and geopolitical competition.

Today, semiconductor manufacturing is strikingly concentrated: around 75% of global capacity lies in China and East Asia, an area vulnerable to geopolitical friction and natural disruptions. Even more narrowly, all leading-edge chips – those fabricated below 10 nanometers – are produced exclusively in Taiwan (92%) and South Korea (8%).

As governments and private actors race to secure access to chips and fabrication capacity, the sector is undergoing simultaneous shifts: restructured supply chains, unprecedented capital investment, and intensifying innovation cycles.

This transformation is propelled above all by the explosive rise of Artificial Intelligence. And as it becomes embedded in industrial operations, AI is transforming industrial project management practices. The adoption of AI-driven planning and analytics tools enables real-time tracking of schedules, budgets and risks. Early evidence suggests organizations leveraging these tools are improving on-time delivery and budget adherence by double-digit percentages.

From industrial automation to generative AI, AI systems depend on highly sophisticated chips capable of processing vast volumes of data at high speed while minimizing energy consumption. According to McKinsey & Company, demand for data-centre capacity is expected to increase by 33% annually through 2030, with as much as 70% of capacity dedicated to AI workloads by the end of the decade.

The semiconductor market itself is projected to exceed USD 1 trillion by 2030, and chips designed specifically for AI acceleration will represent the fastest-growing segment, reaching an estimated USD 400 billion market.

Semiconductors have therefore become the essential infrastructure of the global digital economy. Sustaining the progress of AI now depends on scalable fabrication capacity, advanced packaging capabilities, high-performance data-centre compute, and resilient supply chains. These requirements are reshaping how nations define their industrial strategies and how companies prioritise capital investment. Understanding how the semiconductor industry is evolving is thus essential. The analysis that follows explores the sector’s current configuration, its emerging bottlenecks, and the industrial strategies shaping its future.

Geopolitical Dynamics and Supply-Chain Strategy

Since 2023 the semiconductor sector has become central to geopolitical, economic, and industrial strategy. Once a high-tech manufacturing niche, it is now a core element of national security, technological sovereignty, and industrial policy. The United States, China, and the European Union anchor a rapidly evolving ecosystem where access to advanced chips is both an economic and strategic imperative.

The United States has reinforced its position through the CHIPS and Science Act (2022), mobilising over US $52 billion for domestic manufacturing, R&D, and workforce capacity. In parallel, Washington has tightened export controls on advanced computing and semiconductor equipment, notably through the October 2023 rules, thus accelerating the strategic decoupling with China.

China has responded by intensifying its push for technological self-reliance. Backed by the National Integrated Circuit Industry Investment Fund, Beijing has channelled US $47.5 billion into domestic fabrication capacity since 2024. SMIC’s (Semiconductor Manufacturing International Corporation) progress on advanced nodes reflects this momentum. Recent analysis suggests that China’s 2026–2030 Five-Year Plan will further expand national capabilities and secure a larger share of global mature-node production. Beijing has also introduced new export controls on rare-earth materials, adding upstream pressure to global supply chains.

In Europe, the EU Chips Act (2023) marked a shift in industrial policy. With €43 billion in combined public–private investment, the initiative aims to double Europe’s market share to 20% by 2030. In October 2025, the European Commission approved the first major “Integrated Production Facility” and “Open EU Foundry” projects, signalling the move from design to implementation.

Tensions continue to rise. In September 2025, the U.S. revoked TSMC Nanjing’s validated end-user status, tightening licensing for U.S.-origin equipment in mainland China.

China has since challenged elements of U.S. semiconductor subsidies, indicating that competition now spans advanced nodes, mature technologies, and regulatory domains.

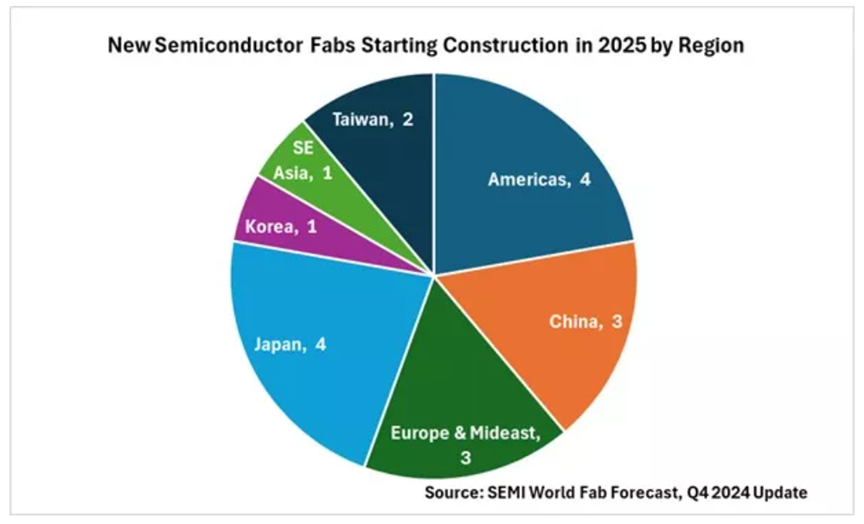

Global manufacturers are meanwhile diversifying. The Semiconductor Equipment and Materials International (SEMI) association reported that 18 new semiconductor fabs were scheduled to start construction in 2025 across the Americas, Europe, and parts of Asia, highlighting an emerging diversification trend beyond China.

For global industrial value chain, this complex environment requires a paradigm shift.

To sustain competitiveness and manage uncertainty, organisations must:

- Build redundancy into global supply chains to mitigate geopolitical disruptions.

- Map and monitor dependencies across materials, tooling, and logistics networks.

- Integrate geopolitical risk assessment directly into project design, scheduling, and capital allocation.

The semiconductor landscape of 2025 thus reflects a new reality: technological capacity is not sufficient. Long-term success will depend equally on the ability to anticipate regulatory evolution, manage cross-border interdependence, and execute complex industrial programmes with strategic foresight and agility.

Emerging Markets: Africa and Latin America

As global players seek to rebalance their supply chains, new geographies are emerging as potential participants in the semiconductor ecosystem. Africa, in particular, is attracting attention for its growing technological workforce and energy resources. The World Economic Forum highlights efforts in Kenya, Rwanda, and South Africa to develop specific industrial clusters. Key enablers include:

- Raw materials: critical minerals like cobalt and tantalum are locally available.

- Young workforce and strategic location: Africa offers a growing tech‑savvy labour pool and logistics access to multiple regions.

- Global partnerships: multinational firms are exploring joint ventures and technology-transfer agreements to support local capacity.

Similarly, Latin America is shaping its role in chip‑supply diversification. According to the Center for Strategic and International Studies (CSIS), the region holds promise in assembly, testing and packaging (ATP) and in supplying raw materials, also supported by strategic partnerships with the United States. In addition, countries such as Brazil and Mexico beginning to formalise semiconductor‑industry strategies. For example, Brazil’s “Brasil Semicon” programme commits public and private investment to stimulate local chip and electronics manufacturing.

These developments offer opportunities, including access to talent, renewable energy, and new logistics corridors, while challenges involve regulatory fragmentation, infrastructure gaps, and local supply-chain readiness.

Thus, effective global industrial projects in these regions require local partnerships, institutional coordination, and capacity transfer, ensuring they contribute to long-term economic development.

India’s Semiconductor Ambitions: From Aspiration to Action

Recently, India has emerged as one of the most dynamic new players in the global semiconductor landscape.

Since launching the India Semiconductor Mission (ISM) in 2021, the government has mobilised roughly US $10 billion in incentives to attract fabrication, assembly, and design projects. By mid-2025, ten major projects across six states had been approved, drawing more about US $19 billion in combined public-private investment.

International collaboration forms the backbone of India’s industrial strategy. A flagship example is Tata Electronics’ partnership with Taiwan’s Powerchip Semiconductor Manufacturing Corp (PSMC) to build a 12-inch wafer fab in Gujarat, a project valued at over US $11 billion. India is also strengthening technological cooperation with the United States through the Transforming the Relationship Utilizing Strategic Technology (TRUST) Initiative, announced in April 2025, which seeks to build trusted supply chains in semiconductors and critical minerals.

Meanwhile, India’s semiconductor market is projected to reach US $110 billion by 2030, supported by domestic demand for electronics, electric vehicles, and AI-driven applications. Talent development is central, with universities and private consortia expanding chip-design and manufacturing programs to support an estimated one million jobs by 2026.

By combining global partnerships with strategic autonomy, India’s approach contrasts sharply with China’s inward-focused model. While challenges remain in infrastructure and advanced manufacturing capabilities, the trajectory is clear: India is positioning itself as a credible, globally integrated semiconductor hub, linking industrial policy, innovation, and strategic project execution.

Global Semiconductor Leaders and Strategic Initiatives

The semiconductor ecosystem is being shaped by a few industrial titans whose investments, relocations, and supply-chain strategies are currently rewriting the geography of chip manufacturing and integration.

Key players include:

- Taiwan Semiconductor Manufacturing Company (TSMC) – Taiwan. Expanding aggressively outside Asia, TSMC is already investing US $65 billion in Arizona to build advanced-node fabs (from 4 nm to 2 nm). Globally, the company plans US $100 billion in additional fabrication, packaging, and R&D through 2028, supporting the AI-driven chip boom.

- Samsung Electronics – South Korea. Developing beyond memory into logic and foundry services, Samsung is investing roughly US $37 billion in Texas through two logic fabs, backed by U.S. subsidies under the CHIPS-era framework.

- Intel Corporation – United States. As a U.S. incumbent, Intel is capitalising on federal support (up to US $7.9 billion in CHIPS Act funding) and committing over US $100 billion to build advanced foundries in Arizona, New Mexico, Oregon and Ohio.

- SMIC – China. China’s leading foundry plans to double its 7 nm production capacity by 2026 while aiming to triple AI chip output, reinforcing Beijing’s semiconductor self‑reliance strategy despite U.S. sanctions.

- ASML – The Netherlands. The world’s only provider of extreme ultraviolet (EUV) lithography machines (a critical equipment for sub-5 nm nodes), ASML’s global role ties manufacturing, equipment and policy together in one supply-chain chokepoint.

Beyond fabrication, companies like NVIDIA shape the semiconductor ecosystem from the design side. Specializing in AI accelerators, NVIDIA is relocating parts of manufacturing and packaging to the U.S. to strengthen supply-chain resilience. Recent measures in China, including export restrictions and regulatory inspections in Autumn 2025, underscore the geopolitical risks confronting global chip designers today.

The semiconductor industry’s transformation over the coming decade will redefine global industrial landscapes. As AI, sustainability, and geopolitics converge, effective coordination of the complex, cross-border semiconductor value chain will be essential to turning industrial ambition into tangible results.

INCONCRETO’s Strategic Vision: Advancing Semiconductor Innovation

Semiconductors sit at the intersection of technological advancement, industrial strategy, and global competitiveness. Achieving success requires integrated planning across supply chains, production, talent development, and sustainability.

INCONCRETO partners with organizations to transform strategic objectives into actionable industrial programs. Through risk management, cross-regional coordination, and operational excellence, we ensure each phase of the semiconductor value chain delivers measurable impact.

By anticipating technological shifts and aligning stakeholders, we help clients turn complexity into long-term value for companies, governments, and the broader technology ecosystem.

For further reading, you may consult these sources:

- Silicon squeeze: AI’s impact on the semiconductor industry, by McKinsey & Co.

- How AI Is Driving Global Investment Patterns, by Bloomberg

- US policy pivot on chip sales in China. What does it mean for global tech?, by WEF

- Semiconductors: China’s Industrial Policy Steamroller in Motion, by The Diplomat

- Advanced Semiconductor Packaging Market Could Reach $80 Billion by 2033, by Bloomberg

- Eighteen New Semiconductor Fabs to Start Construction in 2025, by SEMI

- How Africa could help diversify the booming global semiconductor industry, by WEF

- Latin America’s Role in De-Risking Semiconductor Supply Chains, by CSIS

- The Industry of Semiconductors in India: Building a Future-Ready Ecosystem, by INCONCRETO

Latest News

Semiconductors Today: Global Industry Dynamics and Strategic Value Chains

Mining Today, Powering Tomorrow: The Global Race for Transition Minerals

Newsletter

© INCONCRETO. All rights reserved. Powered by AYM