INCONCRETO NEWS

The Industry of Subsea Cables: Unseen Networks Powering the Global Digital Economy

Subsea (or submarine) cables are fiber-optic cables laid on the seabed between land-based stations.

Long before the digital age, the first global network emerged in 1866 with the transatlantic telegraph cable, linking Europe and North America. This breakthrough enabled near-instant communication, marking the start of global reliance on undersea information infrastructure.

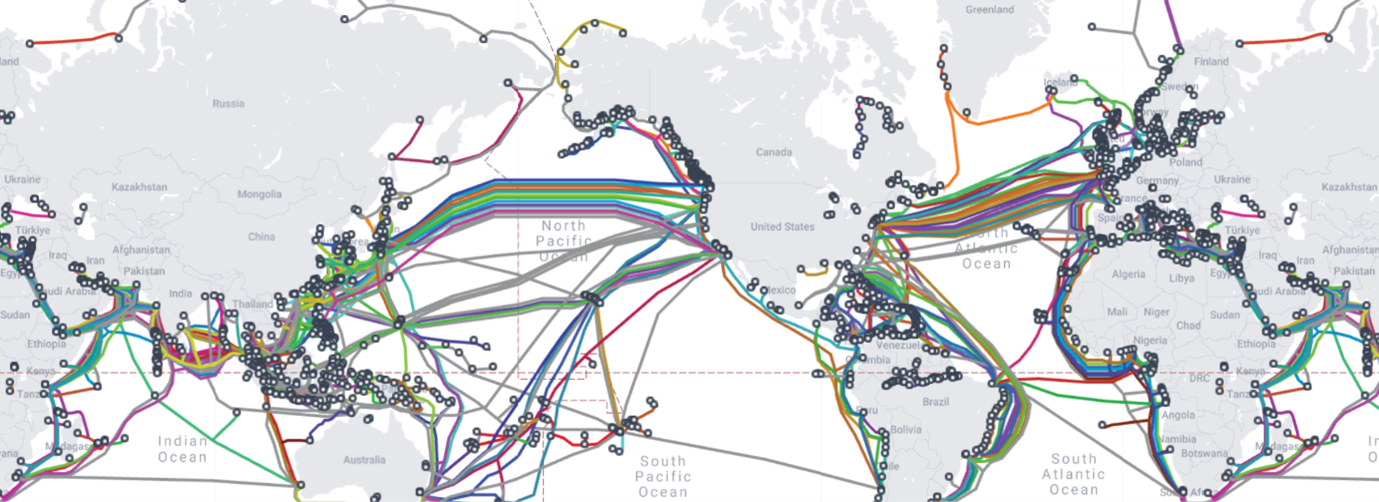

Fast forward to the present: more than 95% of international data traffic, which includes internet, phone, financial, and cloud services, travels through a vast web of fiber-optic submarine cables. These cables remain the fastest, cheapest, and highest-capacity method of global data transmission, rather than satellites. As of 2025, this undersea network spans over 1.4 million kilometers and comprises more than 600 active or planned cables, silently sustaining the global economy and digital life.

The Submarine Cable Map

Submarine cables, though vital, are often overlooked in discussions on strategic infrastructure.

Once controlled by state telecoms, they are now dominated by private U.S.-based tech giants. This shift impacts global governance, data sovereignty, and internet architecture.

As competition over digital influence grows, understanding who builds and controls these undersea networks is crucial to grasping the future of global connectivity and power.

Who Owns the Cables? The Shifting Landscape of Subsea Power

Until the late 1990s, subsea cables were mainly built and managed by state-owned telecom companies and consortia to connect national markets.

Since then, private ownership and non-telecom investors have taken a leading role through commercial investments. Traditional telecom operators now focus on regional specialization, often co-owning cables or leasing capacity, rather than solely building or controlling entire cable systems.

Here is an overview of these main historical telecom players, which are active in the management of subsea cable networks.

- Orange (France) remains a key regional operator, playing a central role in European and African digital infrastructure, with over 450,000 km of subsea cable assets and the Orange Marine fleet. It co-owns the 17,000 km-long ACE cable (Africa Coast to Europe), a vital link between France and West Africa. Orange is also a partner in the Medusa cable connecting Tunisia to France, and the SEA-ME-WE 6 system departing in Marseille and linking France to Singapore.

- NTT (Japan) operates one of the most long-standing submarine cable networks in Asia. Since creating its subsidiary NTT World Engineering Marine, NTT has laid major systems such as the APCN‑2 cable, linking Japan to the U.S., and the Asia‑Pacific Gateway (APG), connecting Japan, Taiwan, Hong Kong, and Southeast Asia.

- Telstra (Australia) today owns or operates over 400,000 km of subsea cable, making it one of the most extensive networks in Asia-Pacific. Core assets include the 12,700 km Australia–Japan Cable (AJC) since 2001, Telstra Endeavour linking Sydney to Hawaii since 2008, and a 25 % stake in Southern Cross NEXT, connecting Sydney to Los Angeles, being operational since mid‑2022.

- Tata Communications (India), formerly the state-run VSNL, now operates one of the world’s largest wholly owned subsea cable networks, spanning over 265,000 km and connecting 200+ countries. Its also exploits key transoceanic routes like TGN-Atlantic and TGN-Intra Asia, providing low-latency connectivity between India, Europe, the U.S., and East Asia.

- U.S. carriers like AT&T, Verizon, and Lumen Technologies still operate cable landing stations, but their strategic role has diminished. As hyperscalers now lead cable investments, these firms focus on resale, infrastructure partnerships, and enterprise services, as illustrated by Lumen’s collaboration with Google on Grace Hopper.

The most dramatic transformation in the cable ecosystem has come from the rise of the Big Tech. Initially consumers of bandwidth and heavy users of internet capacity, they have now transitioned to dominant owners and operators of subsea cable infrastructure, being its principal investors, and increasingly, owners. Their investments reflect strategic moves to control their global data flows, reduce latency, and expand cloud services worldwide.

According to the OECD Paper “Financing the Broadband Networks of the Future” (2024), these companies now co-own or fully own most new subsea cable projects, reshaping the global connectivity landscape.

- Google has been a pioneer in this shift, being involved in the construction of 22 submarine cables since 2010. After launching its first private cable, Curie, in 2019, the company has expanded its network to include major systems such as Dunant, Grace Hopper, Equiano, Firmina, Topaz, and Taiwan-Philippines-U.S. cable (TPU). These cables span the Americas, Europe, Africa, and the Pacific, supporting Google Cloud’s global backbone. Notably, Google’s $1 billion investment plan for Africa aims to enhance connectivity and lower internet costs across the continent. Also, in 2023, Google announced the Nuvem transatlantic subsea cable, connecting Portugal, Bermuda and the U.S., and in November 2024, it presented its plans for Australia Connect, building on its existing Pacific Connect infrastructure. Google is also pioneering multi-core fiber (MCF) technology in its submarine cables (doubling the number of optical cores in a single strand), which significantly rises bandwidth capacity while lowering cost‑per‑bit, firstly deployed in the TPU cable.

- Meta has rapidly increased its footprint in subsea infrastructure, co-investing in 14 cables and fully owning the Anjana cable, a high-capacity transatlantic system connecting South Carolina to Spain, with a theoretical throughput of 480 Tbps. Its flagship $10 billion investment project, Waterworth, is a planned 50,000 km subsea route across five continents, featuring 24 fiber-pair architecture, deep-water route deployment down to 7,000 m, and enhanced burial techniques in high-risk zones. Meta also spearheaded Malbec, extended to Brazil’s southern hub Porto Alegre by 2027.

- Microsoft is similarly active, co-owning four major cables: MAREA, Amitié, SeaMeWe-6 in the Atlantic, and the New Cross Pacific (NCP) system. These cables are integral to supporting Microsoft Azure’s growing cloud infrastructure. In early 2024, Cisco and Microsoft set a new record by sending data at speeds of 800 Gbps across the Amitié transatlantic cable. They used advanced technologies that allow more data to travel simultaneously over multiple fiber pairs, greatly boosting the cable’s capacity and enabling faster, more efficient data transmission over long distances.

- Amazon maintains a lower public profile but is deeply involved in subsea connectivity. It co-built the JUPITER cable system across the Pacific with a consortium and is a major capacity buyer on several projects. In January 2025, Amazon Ireland applied for a maritime usage license to land a new cable in County Cork, Ireland, aiming to enhance connectivity to its extensive network of data centres across Europe. The proposed cable is expected to feature 12 fiber pairs, utilizing spatial division multiplexing (SDM) technology to efficiently manage increasing data traffic.

Together, these four tech giants, which currently account for over 50% of all new subsea cable investment globally, are rapidly becoming the private custodians of the global internet.

Architects Beneath the Waves: The Firms Manufacturing the Internet’s Undersea Highways

Designing, producing, deploying, and servicing submarine cables is a heavy investment in both capital and technology. Only a few specialized firms lead this space, typically under contract with telecom consortiums, hyperscalers, and Governments.

- SubCom (U.S.) is a dominant player, operating a modern fleet of cable‑laying ships and engineering services. In March 2025, it was awarded the full engineering, manufacturing, and installation contract for the MANTA subsea cable system, which will link Mexico, Panama, Colombia, and the U.S. with landing points in Veracruz and San Blas, and support up to 22 Tbps per fiber pair.

- NEC Corporation (Japan) delivers advanced turnkey cable systems across the Asia‑Pacific. In late 2024 it completed the ADC cable connecting China, Japan, the Philippines, and Southeast Asia with over 160 Tbps capacity.

- Alcatel Submarine Networks (France) has engineered flagship cables including 2Africa, Amitié, and the Medusa cable system, an open-access Mediterranean corridor stretching 8,700 km with 24-fiber pairs and per‑pair 20 Tbps capacity.

- HMN Tech (China) is a major subsea cable manufacturer and installer, with over 130 projects completed worldwide. In 2024, it completed the PEACE cable system segment connecting Singapore to France, offering 192 Tbps capacity. Despite U.S. security restrictions limiting its access to some markets, HMN Tech remains a key player in expanding Asia-Africa connectivity through projects like the SHARE cable linking Senegal and Cape Verde.

- Prysmian Group (Italy) serves as a major player in submarine telecom infrastructure through its Submarine Telecom division, based in Nordenham, Germany (inherited via its 2018 acquisition of General Cable/NSW). In 2019, Prysmian secured a €50 million turnkey telecom cable contract to connect Arica with Puerto Montt in Chile, underscoring its ambitions in the field of subsea cable infrastructure, beyond its energy focus.

Regional operators, such as Aqua Comms and Telxius, also play a key role, bridging infrastructure and marketing between manufacturers and global operators. Together, they form the critical industrial layer where technical innovation, geopolitical finance, and global connectivity intersect.

Invisible Infrastructure, Tangible Stakes

Subsea fiber-optic cables may be invisible to most, but they form the physical foundation of the global internet.

As highlighted in a recent analysis by Economy Insights, these cables are not just technical systems but critical infrastructure with growing industrial, logistical, and strategic significance.

Each year, roughly 200 cable faults occur due to fishing activity, anchors, or seismic events, requiring costly repairs and marine operations. In areas with limited connectivity, such as Tonga or Somalia, a single break can cause multi-week blackouts with steep economic consequences. This underscores the urgent need for redundancy, smart cable technology, and robust maintenance fleets.

Beyond technical risks, geopolitical tensions and regulatory hurdles are reshaping how cables are financed, routed, and approved. Projects must now navigate national security reviews, environmental permitting, and complex ownership structures. Yet these challenges also open doors for industrial players, from fiber producers and shipbuilders to engineering consultancies and logistics operators.

As digital demand surges, with AI, cloud computing, and edge services on the rise, undersea cables are entering a new phase of strategic investment.

This evolution positions the cable sector as a high-potential frontier for innovation, resilience planning, and industrial engagement.

Building Resilience in a Connected World: INCONCRETO’s Strategic Approach

Undersea cables are the hidden backbone of the global digital economy: a complex industry demanding a strategic vision beyond technology alone. At INCONCRETO, we blend deep industry knowledge with advanced expertise to help clients navigate the challenges of connectivity infrastructure. By aligning innovation with operational realities, we turn complexity into resilience and opportunity. In today’s interconnected world, intelligence and foresight are the most essential materials for building the future.

For further reading, you may consult these sources:

- The State of the Network, by TeleGeography

- Financing broadband networks of the future, by OECD

- Industry Report 2024-2025, by Submarine Telecoms Forum

- Amazon, Meta and Google Plan Subsea Cable Expansion, by Network Computing

- Undersea Cables. The Invisible Backbone of Global Digital Trade, by Economy Insights

- The Geopolitics of Submarine Cables, the Infrastructure of the Digital Age, by ISPI

- To keep the world’s data flowing, countries need to quickly fix broken undersea cables, in The Bulletin of the Atomic Scientists

Latest News

Semiconductors Today: Global Industry Dynamics and Strategic Value Chains

Mining Today, Powering Tomorrow: The Global Race for Transition Minerals

Newsletter

© INCONCRETO. All rights reserved. Powered by AYM